18+ Key elements of anti money laundering information

Home » about money loundering Info » 18+ Key elements of anti money laundering informationYour Key elements of anti money laundering images are available in this site. Key elements of anti money laundering are a topic that is being searched for and liked by netizens now. You can Download the Key elements of anti money laundering files here. Find and Download all free photos and vectors.

If you’re searching for key elements of anti money laundering images information connected with to the key elements of anti money laundering topic, you have visit the right site. Our website always gives you hints for refferencing the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Key Elements Of Anti Money Laundering. Written Internal Policies Procedures and Controls. It is expected that review happens both periodically and when needed. 5 Pillars of a Successful Anti-Money Laundering Program. 31 Internal policies procedures and controls.

Key Component Of Aml Anti Money Laundering Compliance Program Plianced Inc From plianced.com

Risk management customer care obligations and suspicious transaction reports. Key Categories of BSAAML Risk for Community Banks. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. Each insurance company has to establish and implement policies procedures and internal controls which would also integrate its agents in its anti-money laundering. It is expected that review happens both periodically and when needed. A thorough review against the obligations is an essential part of.

Namely the key four elements as outlined in the relevant figure below for an effective KYC Programme are the following.

A thorough review against the obligations is an essential part of. Under the 4th AMLD a key role is accorded to the principle of risk analysis and the corresponding adequate safeguards. Development of internal policies controls and procedures Internal policies controls and procedures need to be established to. What are the 3 main factors to consider in determining AML risk. The above key elements of the AML programme are discussed in detail below. The BaFin paper focuses on three key elements of anti-money laundering for firms that offer cryptocustody services its three pillars in the fight against money laundering and terrorism financing.

Source: in.pinterest.com

Source: in.pinterest.com

In designing a solid KYCCDD programme there are key elements that need to be incorporated. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. This course will provide a practical overview of the red flags for identification of money laundering the many reporting requirements in the BSA and key elements of an effective anti-money laundering compliance program. Ongoing Training for Employees. Development of internal policies controls and procedures Internal policies controls and procedures need to be established to.

Source: pinterest.com

Source: pinterest.com

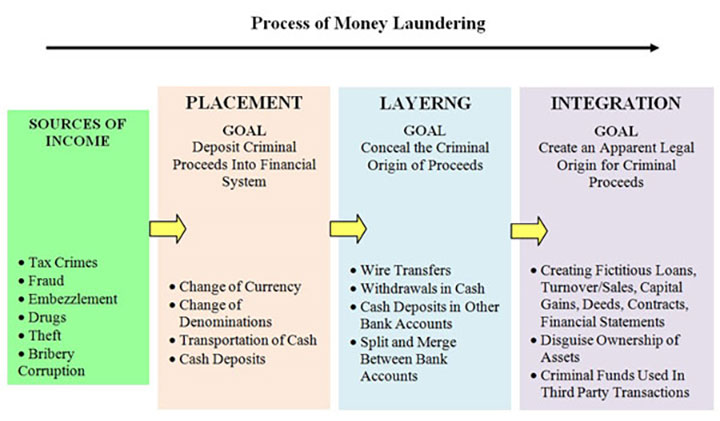

A successful anti-money laundering programme comprises of the following four elements. Based on Anti Money Laundering AML standards. Both the EU Commission and jointly the European supervisory authorities EBA EIOPA and ESMA ESAs shall conduct an analysis of money laundering and terrorism financing risks. Mistaking one for the other is what could cause grave repercussions to weigh down on your company. Its a course of by which soiled money is converted into clean cash.

Source: pinterest.com

Source: pinterest.com

Key elements with a potential impact on AML compliance. Designation of a Compliance Officer. Protect the financial institution against MLTF. Information collected from the customer for the purpose of opening of account shall be kept confidential and the Company shall not divulge any details thereof for cross selling or any other purposes. Each insurance companybroking company has to establish and implement policies procedures and internal controls which would also integrate its agents in its anti-money laundering program as detailed below.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Mistaking one for the other is what could cause grave repercussions to weigh down on your company. Namely the key four elements as outlined in the relevant figure below for an effective KYC Programme are the following. 31 Internal policies procedures and controls. Key Categories of BSAAML Risk for Community Banks. Based on Anti Money Laundering AML standards.

Source: fr.pinterest.com

Source: fr.pinterest.com

The concept of cash laundering is very important to be understood for those working within the monetary sector. Four key elements of an effective KYC programme. A thorough review against the obligations is an essential part of. Written Internal Policies Procedures and Controls. The sources of the cash in actual are criminal and the cash is invested in a means that makes it look like clear money and hide the id of the legal a part of the money earned.

Source: pinterest.com

Source: pinterest.com

Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. Under the 4th AMLD a key role is accorded to the principle of risk analysis and the corresponding adequate safeguards. Protect the financial institution against MLTF. Based on Anti Money Laundering AML standards. Mistaking one for the other is what could cause grave repercussions to weigh down on your company.

Source: unodc.org

Source: unodc.org

The BaFin paper focuses on three key elements of anti-money laundering for firms that offer cryptocustody services its three pillars in the fight against money laundering and terrorism financing. 5 Pillars of a Successful Anti-Money Laundering Program. Both the EU Commission and jointly the European supervisory authorities EBA EIOPA and ESMA ESAs shall conduct an analysis of money laundering and terrorism financing risks. Protect the financial institution against MLTF. It is expected that review happens both periodically and when needed.

Source: shuftipro.com

Source: shuftipro.com

Businesses mandated by Anti-Money Laundering and Countering the Financing of Terrorism regulations must implement and maintain a compliance program to comply with the laws and regulations. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. Key Categories of BSAAML Risk for Community Banks. Four key elements of an effective KYC programme. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents.

Source: plianced.com

Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. Establishing and maintaining risk based customer due diligence identification verification and know your customer procedures including enhanced due. This creates a challenge for financial institutions to ensure that they remain compliant with the Bank Secrecy Act BSA and anti-money laundering regulations. A successful anti-money laundering programme comprises of the following four elements. Each insurance companybroking company has to establish and implement policies procedures and internal controls which would also integrate its agents in its anti-money laundering program as detailed below.

Source: pinterest.com

Source: pinterest.com

The concept of cash laundering is very important to be understood for those working within the monetary sector. A successful anti-money laundering programme comprises of the following four elements. As agreed upon by experts in the field these are the three components your chosen software should have. Businesses mandated by Anti-Money Laundering and Countering the Financing of Terrorism regulations must implement and maintain a compliance program to comply with the laws and regulations. Independent audit of the AML program.

Source: pinterest.com

Source: pinterest.com

Key Categories of BSAAML Risk for Community Banks. This creates a challenge for financial institutions to ensure that they remain compliant with the Bank Secrecy Act BSA and anti-money laundering regulations. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. Key Categories of BSAAML Risk for Community Banks. Four key elements of an effective KYC programme.

Source: researchgate.net

Source: researchgate.net

Risk management customer care obligations and suspicious transaction reports. This creates a challenge for financial institutions to ensure that they remain compliant with the Bank Secrecy Act BSA and anti-money laundering regulations. Development of internal policies controls and procedures Internal policies controls and procedures need to be established to. 5 Pillars of a Successful Anti-Money Laundering Program. A thorough review against the obligations is an essential part of.

Source: pinterest.com

Source: pinterest.com

Both the EU Commission and jointly the European supervisory authorities EBA EIOPA and ESMA ESAs shall conduct an analysis of money laundering and terrorism financing risks. Key elements with a potential impact on AML compliance. 5 Pillars of a Successful Anti-Money Laundering Program. The above key elements of the AML programme are discussed in detail below. Businesses mandated by Anti-Money Laundering and Countering the Financing of Terrorism regulations must implement and maintain a compliance program to comply with the laws and regulations.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title key elements of anti money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas