12+ Key money laundering risk info

Home » about money loundering Info » 12+ Key money laundering risk infoYour Key money laundering risk images are available. Key money laundering risk are a topic that is being searched for and liked by netizens today. You can Find and Download the Key money laundering risk files here. Get all free images.

If you’re looking for key money laundering risk images information connected with to the key money laundering risk interest, you have pay a visit to the right blog. Our website frequently gives you suggestions for seeing the highest quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

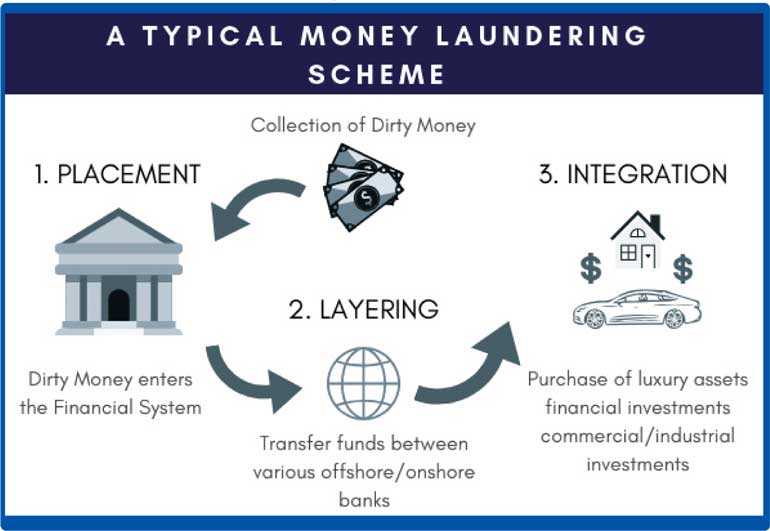

Key Money Laundering Risk. The Five Key Risk Indicators. Its a course of by which soiled cash is converted into clear money. The starting point for effective financial investigations is the awareness and use of accurate financial indicators and transactional red flags indicative of human trafficking for the purpose of labour exploitation. To develop a strong AML compliance program that helps expose bad actors and stay safe from non-compliance fees businesses have to follow quite a few requirements.

Eu Policy On High Risk Third Countries European Commission From ec.europa.eu

Eu Policy On High Risk Third Countries European Commission From ec.europa.eu

All parts of the question can be answered in relation to a jurisdiction with which you are familiar. McAndrew on January 22 2018. The starting point for effective financial investigations is the awareness and use of accurate financial indicators and transactional red flags indicative of human trafficking for the purpose of labour exploitation. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill-gotten gains of crime. The paper also focuses on other aspects that are relating to the topic question. Key money laundering and terrorist financing risks across the EU ECIIA The European Banking Authority EBA published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector.

A customer money laundering risk rating should be properly applied.

Key money laundering and terrorist financing risks across the EU ECIIA The European Banking Authority EBA published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector. The money laundering risk base approach and its key components. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. The paper also focuses on other aspects that are relating to the topic question. The concept of cash laundering is essential to be understood for those working within the monetary sector. The latest risk outlook has just been published by the Accountancy AML Supervisors Group AASG and covers key money laundering risk areas as well as terrorist financing risk areas threatening the.

Source: pinterest.com

Source: pinterest.com

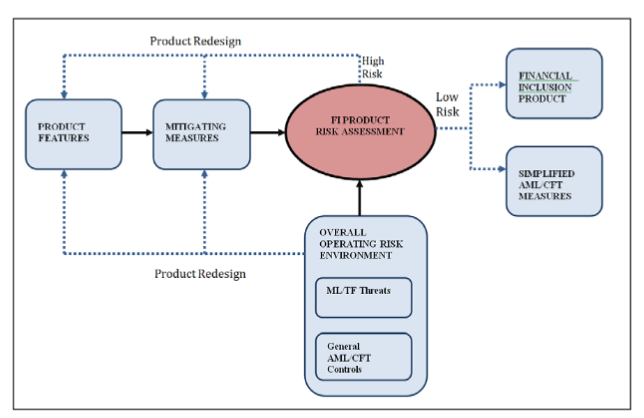

All parts of the question can be answered in relation to a jurisdiction with which you are familiar. Cryptocurrencies and blockchains are set to be a key compliance theme of 2019 with the upcoming Fifth Money Laundering Directive setting out to regulate cryptocurrencies. While the first and most common cryptocurrency is Bitcoin there are now close to 2000 in existence with the number continuing to grow. Globally governments have narrowed key risk indicators to five primary divisions of 1 Nature size and complexity of a business 2 Customer types including B2B and B2C 3 the types of products and services provided to customers 4 method of on-boarding new customers and ongoing communications with existing customers and finally 5. The risk of non-face to face identification due to digital on-boarding.

Source: ft.lk

Source: ft.lk

Key money laundering and terrorist financing risks across the EU ECIIA The European Banking Authority EBA published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector. The money laundering risk base approach and its key components All parts of the question can be answered in relation to a jurisdiction with. Its a course of by which soiled cash is converted into clear money. The European Banking Authority EBA today published its biennial Opinion on risks of money laundering. Country Risk This usually includes an initial assessment of.

Source: plianced.com

Source: plianced.com

Very Low Low Medium High and Very high values should be used. High Risk Products Some banking products are considered higher risk and thus require enhanced checks. The European Banking Authority EBA today published its biennial Opinion on risks of money laundering. Monitoring Real-Time Transactions is a Key Method. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to.

Source: bi.go.id

The starting point for effective financial investigations is the awareness and use of accurate financial indicators and transactional red flags indicative of human trafficking for the purpose of labour exploitation. The aim of an AML compliance program is to detect respond and eliminate inherent and residual money laundering terrorist financing and fraud-related risks. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill-gotten gains of crime. The latest risk outlook has just been published by the Accountancy AML Supervisors Group AASG and covers key money laundering risk areas as well as terrorist financing risk areas threatening the. To develop a strong AML compliance program that helps expose bad actors and stay safe from non-compliance fees businesses have to follow quite a few requirements.

Source: bi.go.id

Source: bi.go.id

The concept of cash laundering is essential to be understood for those working within the monetary sector. All parts of the question can be answered in relation to a jurisdiction with which you are familiar. The paper also focuses on other aspects that are relating to the topic question. Tailored telegraphic transfer software. The starting point for effective financial investigations is the awareness and use of accurate financial indicators and transactional red flags indicative of human trafficking for the purpose of labour exploitation.

Source: bi.go.id

Source: bi.go.id

The European Banking Authority EBA today published its biennial Opinion on risks of money laundering. Cybersecurity and Money Laundering Threats are the Key Risks Facing Banks. While the first and most common cryptocurrency is Bitcoin there are now close to 2000 in existence with the number continuing to grow. What are the key risk indicators for money laundering. McAndrew on January 22 2018.

Source: ec.europa.eu

Source: ec.europa.eu

The aim of an AML compliance program is to detect respond and eliminate inherent and residual money laundering terrorist financing and fraud-related risks. The money laundering risk base approach and its key components. The European Banking Authority EBA today published its biennial Opinion on risks of money laundering. The concept of cash laundering is essential to be understood for those working within the monetary sector. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill-gotten gains of crime.

Source: tookitaki.ai

Source: tookitaki.ai

All parts of the question can be answered in relation to a jurisdiction with which you are familiar. Cybersecurity and Money Laundering Threats are the Key Risks Facing Banks. The money laundering risk base approach and its key components All parts of the question can be answered in relation to a jurisdiction with. Posted in Anti-Money Laundering AML Bank Bank Secrecy Act BSA Beneficial Ownership Customer Due Diligence Cybersecurity Office of the Comptroller of the Currency OCC Last week the Office of the Comptroller. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to.

Source: service.betterregulation.com

Source: service.betterregulation.com

Key money laundering and terrorist financing risks across the EU ECIIA The European Banking Authority EBA published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector. The latest risk outlook has just been published by the Accountancy AML Supervisors Group AASG and covers key money laundering risk areas as well as terrorist financing risk areas threatening the. The starting point for effective financial investigations is the awareness and use of accurate financial indicators and transactional red flags indicative of human trafficking for the purpose of labour exploitation. While the first and most common cryptocurrency is Bitcoin there are now close to 2000 in existence with the number continuing to grow. 9 The following key risk indicators KRIs 10 may increase the likelihood of effective reporting and.

Source: bi.go.id

Source: bi.go.id

The money laundering risk base approach and its key components. The Five Key Risk Indicators. The sources of the money in precise are legal and the money is invested in a manner that makes it look like clear cash and conceal the identification of the felony a part. All parts of the question can be answered in relation to a jurisdiction with which you are familiar. The EBA highlights key money laundering and terrorist financing risks across the EU 03 March 2021 The MLTF risks identified by the EBA include those that are applicable to the entire financial system for instance the use of innovative financial services while others affect specific sectors such.

Source: baselgovernance.org

Source: baselgovernance.org

The concept of cash laundering is essential to be understood for those working within the monetary sector. Monitoring Real-Time Transactions is a Key Method. 9 The following key risk indicators KRIs 10 may increase the likelihood of effective reporting and. The risk of non-face to face identification due to digital on-boarding. The latest risk outlook has just been published by the Accountancy AML Supervisors Group AASG and covers key money laundering risk areas as well as terrorist financing risk areas threatening the.

Source: slideshare.net

Source: slideshare.net

The concept of cash laundering is essential to be understood for those working within the monetary sector. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Country Risk This usually includes an initial assessment of. This is a paper that focuses on the money laundering risk base approach and its key components.

Source: bi.go.id

Source: bi.go.id

The findings of the money laundering risk assessment. Key money laundering and terrorist financing risks across the EU ECIIA The European Banking Authority EBA published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector. The paper also focuses on other aspects that are relating to the topic question. The money laundering risk base approach and its key components. Its a course of by which soiled cash is converted into clear money.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title key money laundering risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas