18++ Know your customer risk rating information

Home » about money loundering Info » 18++ Know your customer risk rating informationYour Know your customer risk rating images are ready. Know your customer risk rating are a topic that is being searched for and liked by netizens today. You can Find and Download the Know your customer risk rating files here. Download all royalty-free images.

If you’re searching for know your customer risk rating images information linked to the know your customer risk rating interest, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

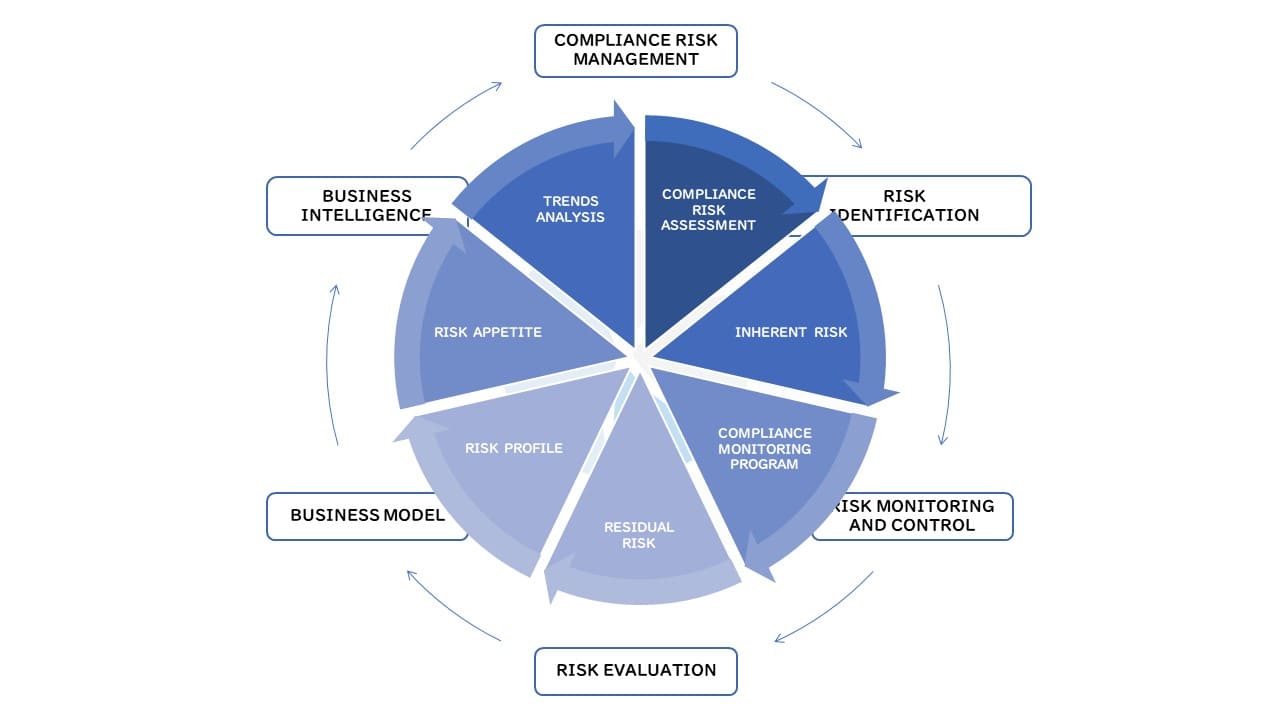

Know Your Customer Risk Rating. How KYC Risk Rating Works. Our risk ranking tool has been designed to provide a measure of the money laundering risk of countries that your organisation might have client relationships with or doing business with. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. Commonly referred to as the customer risk rating.

Kyc Chain Blockchain Banking Kyc Aml Compliance Solution From kyc-chain.com

Kyc Chain Blockchain Banking Kyc Aml Compliance Solution From kyc-chain.com

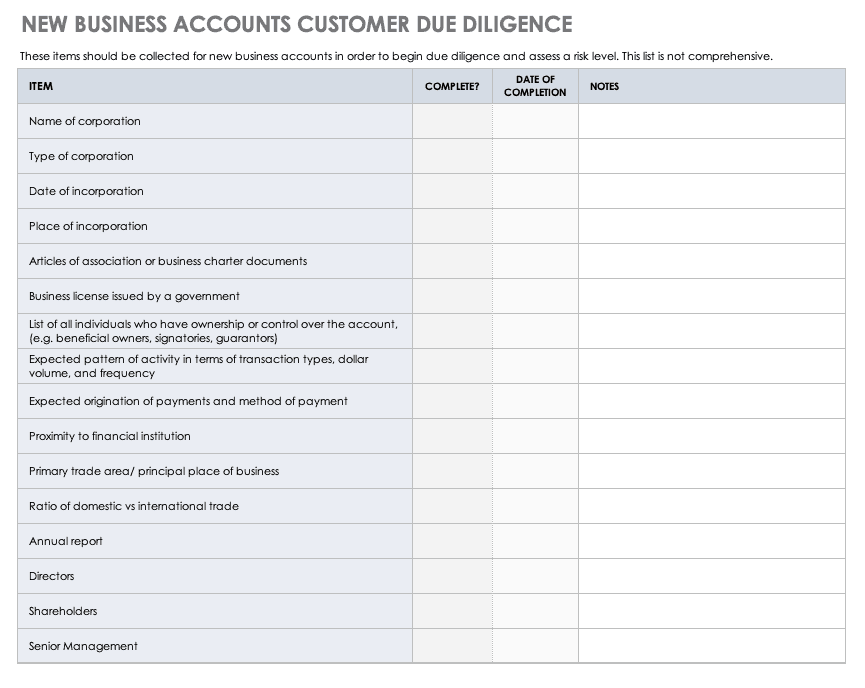

Moreover the bank should assign the customer a risk rating to assess how they should watch the account and which customers pose too significant a risk to take on as new clients. Know Your Customer is the due diligence that Banks must perform to identify their clients and ascertain relevant information pertinent to doing business with them. Most institutions calculate both of these risk ratings as each of them is equally important. KYC is a continuous process of assessment and not a one time assessment of a customer. Customers are assessed in different stages of their relationship with the bank or FI. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures.

The ongoing monitoring of customer involves overseeing of transactions based on thresholds stated as part of a customers risk score.

Know Your Employee KYE. Is it a requirement under the CDD Rule that covered financial institutions. Specifically the questions are. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. The ongoing monitoring of customer involves overseeing of transactions based on thresholds stated as part of a customers risk score.

Source: pideeco.be

Source: pideeco.be

Most institutions calculate both of these risk ratings as each of them is equally important. Customers are assessed in different stages of their relationship with the bank or FI. If warranted banks would ask consumers for more information such as their occupation a description of business operations source of funding their accounts. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Is it a requirement under the CDD Rule that covered financial institutions.

Source: processmaker.com

Source: processmaker.com

Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers. C FIHFC should seek only such information which is relevant to the risk category of the customer. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers. Know Your Customer KYC data can serve as a valuable risk assessment tool for banks by providing information that can identify customers who are more likely to default on a loan.

Source: kyc3.com

Source: kyc3.com

A KYC risk rating is simply a calculation of risk. The KYC risk rating is a calculation of risk. Know Your Customer KYC data can serve as a valuable risk assessment tool for banks by providing information that can identify customers who are more likely to default on a loan. Based upon data collected from many international and government agencies we have subjectively weighted the findings to provide a free rating tool that is predominantly focused on money laundering and. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio.

Source: kyc3.com

Source: kyc3.com

Customers are assessed in different stages of their relationship with the bank or FI. B Parameters of risk perception should be defined to classify customers as low medium and high risk keeping in view customers identity the nature of business activity location of customer social and financial status. Specifically the questions are. The ongoing monitoring of customer involves overseeing of transactions based on thresholds stated as part of a customers risk score. Customers are assessed in different stages of their relationship with the bank or FI.

Source: indiaforensic.com

Source: indiaforensic.com

Specifically the questions are. B Parameters of risk perception should be defined to classify customers as low medium and high risk keeping in view customers identity the nature of business activity location of customer social and financial status. Commonly referred to as the customer risk rating. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers.

Source:

B Parameters of risk perception should be defined to classify customers as low medium and high risk keeping in view customers identity the nature of business activity location of customer social and financial status. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. Know Your Customer KYC Know Your Business KYB Know Your Customer - Risk Rating.

Source: akseleran.co.id

Source: akseleran.co.id

B Parameters of risk perception should be defined to classify customers as low medium and high risk keeping in view customers identity the nature of business activity location of customer social and financial status. The ongoing monitoring of customer involves overseeing of transactions based on thresholds stated as part of a customers risk score. 255 rows To determine a customers overall risk rating a select list of variables are assessed and. C FIHFC should seek only such information which is relevant to the risk category of the customer. Further a spectrum of risks may be identifiable even within the same category of customers.

Source: factly.in

Source: factly.in

Customers are assessed in different stages of their relationship with the bank or FI. The FinCEN update focuses on answering questions about information that should be gathered at account opening requirements for risk rating customers and KYC file refresh. C FIHFC should seek only such information which is relevant to the risk category of the customer. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Making this calculation ensures that organizations do not do business with a person involved in another financial crime such as money laundering or terrorist financing.

Source: kyc3.com

Source: kyc3.com

The FinCEN update focuses on answering questions about information that should be gathered at account opening requirements for risk rating customers and KYC file refresh. Most institutions calculate both of these risk ratings as each of them is equally important. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. Moreover the bank should assign the customer a risk rating to assess how they should watch the account and which customers pose too significant a risk to take on as new clients. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool.

Source: smartsheet.com

Source: smartsheet.com

Know Your Employee KYE. Know Your Customer KYC Know Your Business KYB Know Your Customer - Risk Rating. A KYC risk rating is simply a calculation of risk. Know Your Employee KYE. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

Source: processmaker.com

Source: processmaker.com

Commonly referred to as the customer risk rating. Most institutions calculate both of these risk ratings as each of them is equally important. A KYC risk rating is simply a calculation of risk. Know Your Customer KYC Know Your Business KYB Know Your Customer - Risk Rating. What is KYC Risk Rating.

Source: kyc-chain.com

Source: kyc-chain.com

The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. Know Your Customer is the due diligence that Banks must perform to identify their clients and ascertain relevant information pertinent to doing business with them. Know Your Customer KYC Know Your Business KYB Know Your Customer - Risk Rating. 255 rows To determine a customers overall risk rating a select list of variables are assessed and. Specifically the questions are.

Source: kyc3.com

Source: kyc3.com

Specifically the questions are. Most institutions calculate both of these risk ratings as each of them is equally important. Commonly referred to as the customer risk rating. What is KYC Risk Rating. Know Your Employee KYE.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title know your customer risk rating by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas