19+ Kyc aml ppt ideas

Home » about money loundering Info » 19+ Kyc aml ppt ideasYour Kyc aml ppt images are ready. Kyc aml ppt are a topic that is being searched for and liked by netizens now. You can Get the Kyc aml ppt files here. Find and Download all royalty-free vectors.

If you’re looking for kyc aml ppt images information related to the kyc aml ppt interest, you have pay a visit to the ideal blog. Our site always provides you with suggestions for downloading the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that fit your interests.

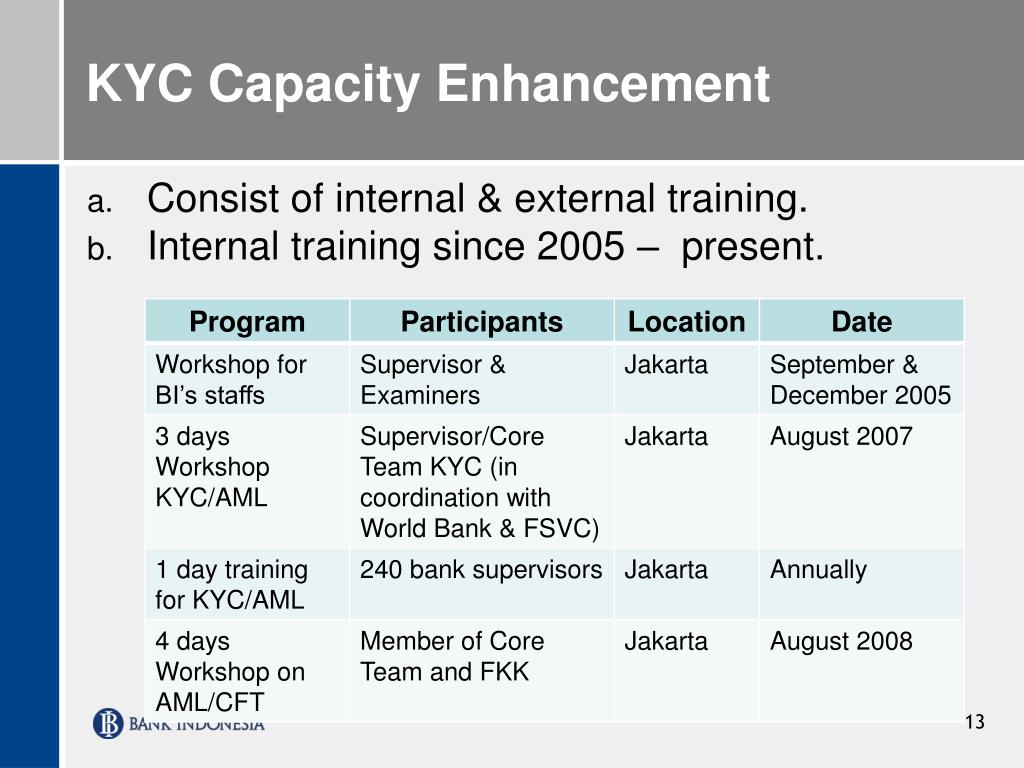

Kyc Aml Ppt. Read this article to know all about KYC Documents KYC Process KYC Benefits KYC Requirements KYC. Know Your Customer - What is KYC Its Requirements and Benefits. Anti Money Laundering AML Learnings from Banks Compliance Group-AML July 16 2010 Agenda Agenda Know Your Customer KYC Reserve Bank of India RBI circular on AML. Global Anti money Laundering Software Market Report 2018-2023 - Anti-money laundering software is software used in the finance and legal industries to meet the legal requirements for financial institutions and other regulated entities to prevent or report money laundering activities.

How To Go About Planning A Crypto Exchange Development Business Infographic Design Template Infographic Design Layout Infographic Design From pinterest.com

How To Go About Planning A Crypto Exchange Development Business Infographic Design Template Infographic Design Layout Infographic Design From pinterest.com

Money Laundering is the process by which illegal funds and assets are. Anti money laundering. CDDKYC AND FINANCIAL INSTITUTIONS KYC information gathering CDD continuous checks and monitoring of the information gathered and subsequent monitoringCDDKYC THE BEST INTERNATIONAL STANDARD PRACTICE IN AMLCFT 8. Illegal Legal Dirty Conversion whiteMoney MoneyDefinition. International AML standards already address mobile financial services vulnerabilities No need for new standards Offer great flexibility for low-risk transactions They claim current regulations often do not. Global Anti money Laundering Software Market Report 2018-2023 - Anti-money laundering software is software used in the finance and legal industries to meet the legal requirements for financial institutions and other regulated entities to prevent or report money laundering activities.

Refreshed policies procedures processes iii.

Illegal Legal Dirty Conversion whiteMoney MoneyDefinition. AML KYC Process Flow. Shared service centres and external utilities viii. Anti money laundering. There are four basic types of software that address anti-money laundering. If you continue browsing the site you agree to the use of cookies on this website.

Source: slideplayer.info

Source: slideplayer.info

AML KYC Process Flow. Latest news reports from the medical literature videos from the experts and more. Address full spectrum of entities MNOs Provide clarity on licensing process Take. International AML standards already address mobile financial services vulnerabilities No need for new standards Offer great flexibility for low-risk transactions They claim current regulations often do not. AML KYC Process Flow.

Source: pinterest.com

Source: pinterest.com

Global KYC AML governance vii. The Reserve Bank of India had introduced KYC norms for all banks in 2002 and has been improving on them ever since. Cost of non-Compliance Monetary eg fines etc Loss of autonomy and reputation Increased regulatory intervention scrutiny RBI to keep in mind KYC violations in account opening asset cases while processing any application for regulatory approval Restrictions on business eg. Money Laundering is the process by which illegal funds and assets are. Global Anti money Laundering Software Market Report 2018-2023 - Anti-money laundering software is software used in the finance and legal industries to meet the legal requirements for financial institutions and other regulated entities to prevent or report money laundering activities.

Source: pinterest.com

Source: pinterest.com

Market Level Mobile Money Interoperability Not Currently In Place. Read this article to know all about KYC Documents KYC Process KYC Benefits KYC Requirements KYC. KYC Know your Customer Know Your Customer Policy. Due diligence process ii. Know Your Customer - What is KYC Its Requirements and Benefits.

Source: slideserve.com

Source: slideserve.com

Reserve Bank of India has advised banks to make the Know Your Customer KYC procedures mandatory while opening and operating the accounts and has issued the KYC guidelines under Section 35 A of the Banking Regulation Act 1949. Global Anti money Laundering Software Market Report 2018-2023 - Anti-money laundering software is software used in the finance and legal industries to meet the legal requirements for financial institutions and other regulated entities to prevent or report money laundering activities. KYC Know your Customer Know Your Customer Policy. International AML standards already address mobile financial services vulnerabilities No need for new standards Offer great flexibility for low-risk transactions They claim current regulations often do not. Ad AML coverage from every angle.

Source: slideserve.com

Source: slideserve.com

KYC and mobile phone services FATF and WB advise. Hotel Hilton Towers Mumbai Date. The Reserve Bank of India had introduced KYC norms for all banks in 2002 and has been improving on them ever since. E-KYC Commodity Tatkal Account E-KYC Process Step 1 Fill the required details in Registration form and click on Submit E-KYC Process Step 2 After filling. Latest news reports from the medical literature videos from the experts and more.

Source: pinterest.com

Source: pinterest.com

Transaction monitoring systems. Reserve Bank of India has advised banks to make the Know Your Customer KYC procedures mandatory while opening and operating the accounts and has issued the KYC guidelines under Section 35 A of the Banking Regulation Act 1949. International AML standards already address mobile financial services vulnerabilities No need for new standards Offer great flexibility for low-risk transactions They claim current regulations often do not. CDDKYC AND FINANCIAL INSTITUTIONS CDD - Customer Due Diligence KYC - Know Your Customer Identification. Money Laundering is the process by which illegal funds and assets are.

Source: pinterest.com

Source: pinterest.com

Anti Money Laundering AML Learnings from Banks Compliance Group-AML July 16 2010 Agenda Agenda Know Your Customer KYC Reserve Bank of India RBI circular on AML. Global KYC AML governance vii. Cost of non-Compliance Monetary eg fines etc Loss of autonomy and reputation Increased regulatory intervention scrutiny RBI to keep in mind KYC violations in account opening asset cases while processing any application for regulatory approval Restrictions on business eg. CDDKYC AND FINANCIAL INSTITUTIONS KYC information gathering CDD continuous checks and monitoring of the information gathered and subsequent monitoringCDDKYC THE BEST INTERNATIONAL STANDARD PRACTICE IN AMLCFT 8. The Reserve Bank of India had introduced KYC norms for all banks in 2002 and has been improving on them ever since.

Source: slideshare.net

Source: slideshare.net

Due diligence process ii. Anti Money Laundering AML Learnings from Banks Compliance Group-AML July 16 2010 Agenda Agenda Know Your Customer KYC Reserve Bank of India RBI circular on AML. Revocation of licenses Personal liability. AML KYC Process Flow. Latest news reports from the medical literature videos from the experts and more.

Source: slideshare.net

Source: slideshare.net

KYC and mobile phone services FATF and WB advise. Address full spectrum of entities MNOs Provide clarity on licensing process Take. Market Level Mobile Money Interoperability Not Currently In Place. BASICS OF AML KYC Presentation by Rohit Girdhar Rishu Yadav Aman kashyab Sumit Malik Abishake bansal Slideshare uses cookies to improve functionality and performance and to provide you with relevant advertising. Illegal Legal Dirty Conversion whiteMoney MoneyDefinition.

Source: in.pinterest.com

Source: in.pinterest.com

CDDKYC AND FINANCIAL INSTITUTIONS KYC information gathering CDD continuous checks and monitoring of the information gathered and subsequent monitoringCDDKYC THE BEST INTERNATIONAL STANDARD PRACTICE IN AMLCFT 8. Due diligence process ii. Ad AML coverage from every angle. Anti money laundering. Reserve Bank of India has advised banks to make the Know Your Customer KYC procedures mandatory while opening and operating the accounts and has issued the KYC guidelines under Section 35 A of the Banking Regulation Act 1949.

Source: pinterest.com

Source: pinterest.com

KYC AML - Free download as Powerpoint Presentation ppt PDF File pdf Text File txt or view presentation slides online. AML KYC Process Flow. Cost of non-Compliance Monetary eg fines etc Loss of autonomy and reputation Increased regulatory intervention scrutiny RBI to keep in mind KYC violations in account opening asset cases while processing any application for regulatory approval Restrictions on business eg. AML Knowledge Check 27. KNOW YOUR CUSTOMER AND ANTI-MONEY LAUNDERING MONEY LAUNDRERING AND BANKS Prevent criminal elements from using the Bank for money laundering activities Money.

Source: slideteam.net

Source: slideteam.net

KNOW YOUR CUSTOMER AND ANTI-MONEY LAUNDERING MONEY LAUNDRERING AND BANKS Prevent criminal elements from using the Bank for money laundering activities Money. There are four basic types of software that address anti-money laundering. Better reporting of risks v. Anti money laundering. KYC Know your Customer Know Your Customer Policy.

Source: slideserve.com

Source: slideserve.com

Know Your Customer Anti Money Laundering Slideshare uses cookies to improve functionality and performance and to provide you with relevant advertising. Revocation of licenses Personal liability. Know Your Customer - What is KYC Its Requirements and Benefits. International AML standards already address mobile financial services vulnerabilities No need for new standards Offer great flexibility for low-risk transactions They claim current regulations often do not. KNOW YOUR CUSTOMER AND ANTI-MONEY LAUNDERING MONEY LAUNDRERING AND BANKS Prevent criminal elements from using the Bank for money laundering activities Money.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kyc aml ppt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas