11++ Kyc and aml procedures info

Home » about money loundering Info » 11++ Kyc and aml procedures infoYour Kyc and aml procedures images are available in this site. Kyc and aml procedures are a topic that is being searched for and liked by netizens today. You can Download the Kyc and aml procedures files here. Find and Download all free photos.

If you’re looking for kyc and aml procedures images information connected with to the kyc and aml procedures interest, you have pay a visit to the right site. Our website frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

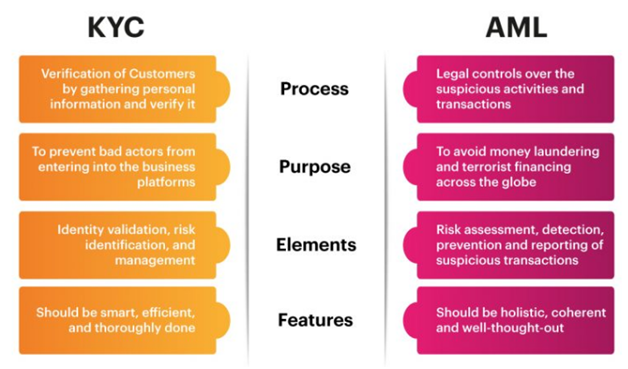

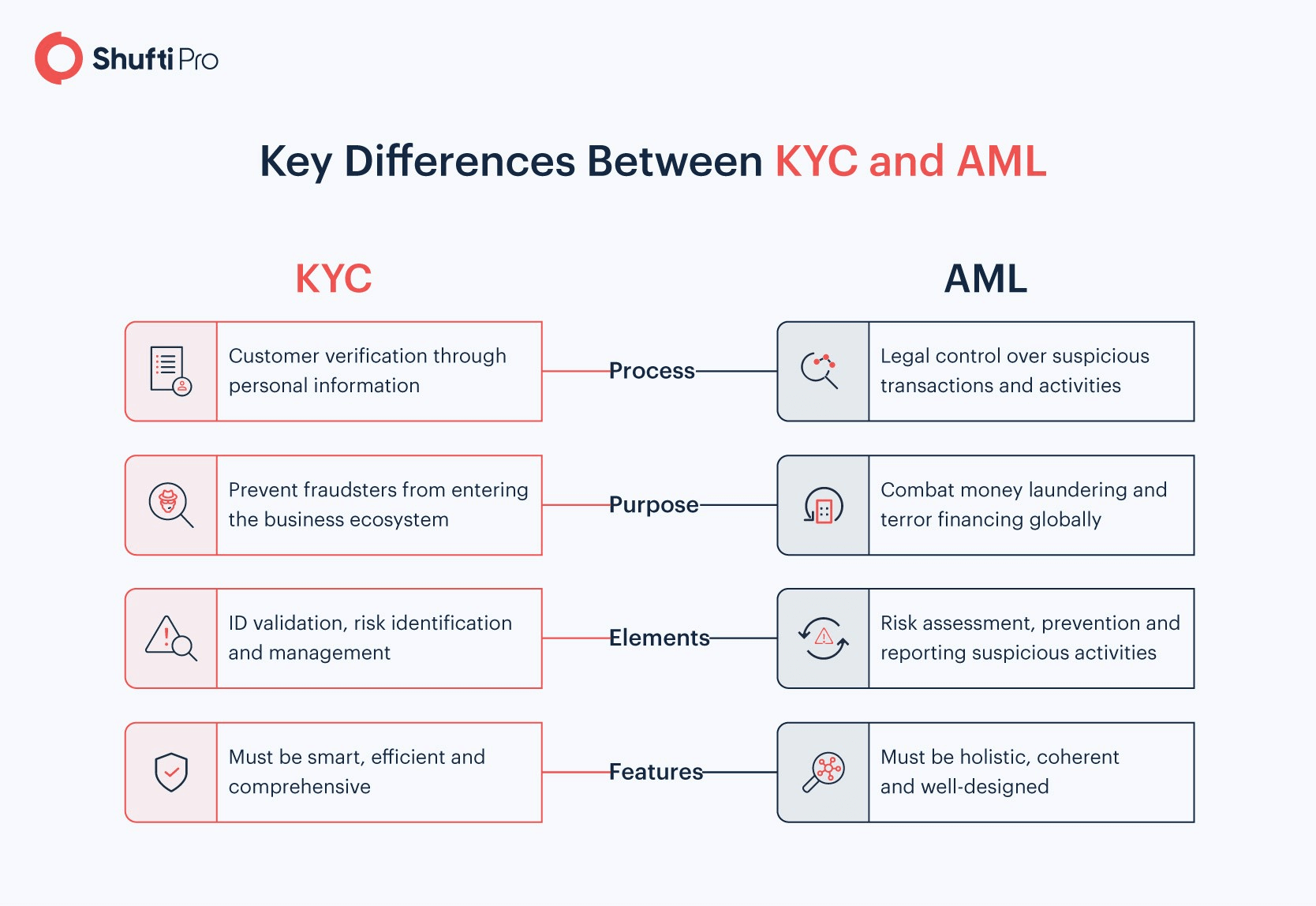

Kyc And Aml Procedures. The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose. KYC is the identity verification process of a new customer and it is part of a broader regulatory compliance requirement. When a financial institution onboards a new customer KYC procedures are in place to identify and verify that a customer is who they say they are. What is KYC in Banking.

Banking Compliance Software Kyc Aml Suitability And Transfer Software For Private Banking From specitec.com

Banking Compliance Software Kyc Aml Suitability And Transfer Software For Private Banking From specitec.com

See our articles Customer Due Diligence and Enhanced Due diligence for more details on these procedures. KYC procedures are empowering businesses to fulfill their AML compliance and eliminate fraud across industries. The main difference between KYC and AML is that KYC is a procedure whereas AML is a full framework. The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose. Customer Identification Program CIP Phase. Training courses for employees.

So What is KYC.

Kyc and amlcft procedures. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Ad AML coverage from every angle. You must document the customer identification procedures you use for different types of customers. When a financial institution onboards a new customer KYC procedures are in place to identify and verify that a customer is who they say they are. According to Anti Money Laundering and Know Your Customer KYC regulations financial institutions must apply a risk assessment to their new customers.

Source: blog.covery.ai

KYC and AML procedures. Latest news reports from the medical literature videos from the experts and more. OBJECTIVE The objective of KYCAMLCFT guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities. The main difference between KYC and AML is that KYC is a procedure whereas AML is a full framework. Any other topics required by the applicable law and regulations.

Source: tookitaki.ai

Source: tookitaki.ai

So What is KYC. The main difference between KYC and AML is that KYC is a procedure whereas AML is a full framework. KYC is short for Know your customer the process used by some ICOs to verify the identity of its Investors or customers. Sanctions and PEP lists screening. KYC and AML.

Source: blog.complycube.com

Source: blog.complycube.com

Latest news reports from the medical literature videos from the experts and more. According to Anti Money Laundering and Know Your Customer KYC regulations financial institutions must apply a risk assessment to their new customers. KYC is short for Know your customer the process used by some ICOs to verify the identity of its Investors or customers. Anti-money laundering cryptocurrency regulations are the first step in this. Latest news reports from the medical literature videos from the experts and more.

Source: processmaker.com

Source: processmaker.com

One of the international standards for preventing illegal activity is customer due diligence CDD. KYC can be considered as a set of tools and procedures one of the features of a complex global AMLCTF policy just like CDD Customer Due Diligence EDD Enhanced Due Diligence and. Ad AML coverage from every angle. Sanctions and PEP lists screening. Effective KYC involves knowing a customers identity their financial activities and the risk they pose.

Source: vskills.in

Source: vskills.in

Sanctions and PEP lists screening. Ad AML coverage from every angle. KYC is the identity verification process of a new customer and it is part of a broader regulatory compliance requirement. Latest news reports from the medical literature videos from the experts and more. Customer Identification Program CIP Phase.

Source: quora.com

AMLKYC procedure includes confirming the identity of Users by means of. This is one of the most significant use cases of KYC. So just to make it clear. Customer Identification Program CIP Phase. OBJECTIVE The objective of KYCAMLCFT guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities.

Source: specitec.com

Source: specitec.com

Friday 08 March 2019 It is the policy of Curio AG the Company to prohibit and prevent money laundering and any activity that facilitates money laundering or the funding of terrorist or criminal activities. AMLKYC procedure includes confirming the identity of Users by means of. So just to make it clear. KYC procedures are empowering businesses to fulfill their AML compliance and eliminate fraud across industries. Rules like the US Bank Secrecy Act and the EUs 4th Anti Money Laundering DirectiveAML and KYC regulations vary across countries however the basis is.

Source: shuftipro.com

Source: shuftipro.com

Customer identification KYC is the key to performing effective counter-measures to laundering of dirty money avoiding taxes financing terrorism and various fraud yet its just one of the parts of AML. KYC is short for Know your customer the process used by some ICOs to verify the identity of its Investors or customers. So What is KYC. KYC refers to identity verification procedures used to ensure customers are who they say they are. OBJECTIVE The objective of KYCAMLCFT guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities.

Source: shuftipro.com

Source: shuftipro.com

AML is the umbrella term for the entire set of mechanisms deployed to protect against money laundering and financial crime. The difference between AML and KYC is that AML anti-money laundering is an umbrella term for the range of regulatory processes firms must have in place whereas KYC Know Your Customer is a component part of AML that consists of firms verifying their customers identity. KYC can be considered as a set of tools and procedures one of the features of a complex global AMLCTF policy just like CDD Customer Due Diligence EDD Enhanced Due Diligence and. KYC is short for Know your customer the process used by some ICOs to verify the identity of its Investors or customers. It also offers frictionless customer experience during customer onboarding as they are performed thoroughly by KYC experts.

This is one of the most significant use cases of KYC. It also offers frictionless customer experience during customer onboarding as they are performed thoroughly by KYC experts. KYC can be considered as a set of tools and procedures one of the features of a complex global AMLCTF policy just like CDD Customer Due Diligence EDD Enhanced Due Diligence and. Latest news reports from the medical literature videos from the experts and more. AML is the umbrella term for the entire set of mechanisms deployed to protect against money laundering and financial crime.

Source: bi.go.id

Source: bi.go.id

Latest news reports from the medical literature videos from the experts and more. Ad AML coverage from every angle. Friday 08 March 2019 It is the policy of Curio AG the Company to prohibit and prevent money laundering and any activity that facilitates money laundering or the funding of terrorist or criminal activities. So What is KYC. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures.

When a financial institution onboards a new customer KYC procedures are in place to identify and verify that a customer is who they say they are. Latest news reports from the medical literature videos from the experts and more. The difference between AML and KYC is that AML anti-money laundering is an umbrella term for the range of regulatory processes firms must have in place whereas KYC Know Your Customer is a component part of AML that consists of firms verifying their customers identity. AML is the umbrella term for the entire set of mechanisms deployed to protect against money laundering and financial crime. Latest news reports from the medical literature videos from the experts and more.

Source: blog.complycube.com

Source: blog.complycube.com

You must document the customer identification procedures you use for different types of customers. Latest news reports from the medical literature videos from the experts and more. Any other checks aimed to evaluate or dispel any suspect patterns. OBJECTIVE The objective of KYCAMLCFT guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities. So What is KYC.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kyc and aml procedures by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas