19+ Kyc and anti money laundering questions and answers ideas

Home » about money loundering idea » 19+ Kyc and anti money laundering questions and answers ideasYour Kyc and anti money laundering questions and answers images are available in this site. Kyc and anti money laundering questions and answers are a topic that is being searched for and liked by netizens today. You can Download the Kyc and anti money laundering questions and answers files here. Download all free photos and vectors.

If you’re searching for kyc and anti money laundering questions and answers pictures information connected with to the kyc and anti money laundering questions and answers keyword, you have visit the ideal site. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

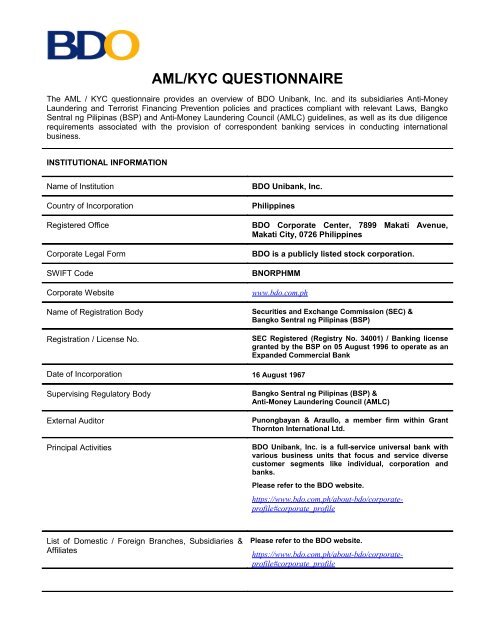

Kyc And Anti Money Laundering Questions And Answers. IIBF AML-KYC Certification Registration Fees. What are the documents to be given as proof of identity and proof of address. Failure to report suspicious activity can carry a criminal sentence and lead to substantial fines from the relevant. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably.

Top 10 Questions About Aml Compliance Answered By The Cto Of Shufti Pro From shuftipro.com

Top 10 Questions About Aml Compliance Answered By The Cto Of Shufti Pro From shuftipro.com

The Anti-Money Laundering regulations are governed by 4 Acts. Seven key questions answered. Know your customer KYC KYC is the anti-money-laundering requirement on banks and other financial intermediaries to verify the identity and beneficial ownership of all their customers. The Proceeds of Crime Act The Serious Organised Crime and Police Act The Terrorist Act and the Money Laundering Regulations. The main goal of the KYC questionnaire update is to improve internal procedures and align it with the Anti Money Laundering AML and Know Your Client KYC policies effective in the European Union EU or other markets we are operating in. It also allows firms to minimize the adverse impact of anti-money laundering procedures on their low-risk customers.

It also allows firms to minimize the adverse impact of anti-money laundering procedures on their low-risk customers.

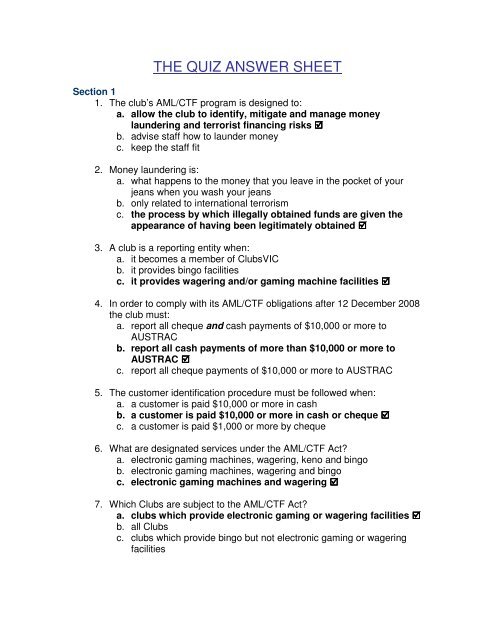

Anti-Money laundering Interview Questions and Answers Q1What Is Money Laundering. 300 TOP ANTI MONEY LAUNDERING Interview Questions and Answers. Anti-Money Laundering Quiz questions. At WorkFusion we work a lot with AML automation and banking automation in general so we are happy to answer some of the most interesting questions from the webinar here. Is It Compulsory To Furnish Aadhaar Card For Opening An Account. Why is it required.

Exam Code AML-KYC. Money laundering Money laundering includes channelling the proceeds of crime through the legitimate financial system in order to disguise their illegal origin. Seven key questions answered. Exam Duration 120 minutes. Money laundering has become a pertinent problem worldwide threatening the stability of various regions by actively supporting and strengthening terrorist networks and criminal organizations.

Source: yumpu.com

Source: yumpu.com

Anti-money Laundering Quiz Questions. Dealing with any property not knowing the property is proceeds of crime. Money Laundering is the process by which criminals attempt to make the proceeds of crime appear legitimate with no obvious links to their criminal origins. 300 REAL TIME. Anti-Money laundering Interview Questions and Answers Q1What Is Money Laundering.

Source: pdfprof.com

Source: pdfprof.com

Dealing with any property believing the property is proceeds of crime. EligibilityPre-Requisite As suggested Exam Fee Rs. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably. 300 REAL TIME. There are three stages involved in money laundering.

Money laundering is the act of failing to disclose money got by criminal means and passing it off as legitimate money. The Anti-Money Laundering regulations are governed by 4 Acts. Anti-money Laundering Quiz Questions. New rules relating to anti-money laundering law now apply in the UK. There are three stages involved in money laundering.

Source: docplayer.net

Source: docplayer.net

What are the KYC requirements for opening a bank account. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably. Dealing with any property believing the property is proceeds of crime. 120 Objective - Multiple Choice Questions MCQs Total Marks. It also allows firms to minimize the adverse impact of anti-money laundering procedures on their low-risk customers.

Source: yumpu.com

Source: yumpu.com

Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. Dealing with any property not knowing the property is proceeds of crime. Why Is It Required. At a recent seminar organised by the Responsible Art Market Initiative RAM a panel of experts answered questions from the floor about the new law. Anti Money Laundering Interview Questions.

Anti-money Laundering Quiz Questions. Anti-Money Laundering Quiz questions. Exam Duration 120 minutes. IIBF AML-KYC Certification Registration Fees. At a recent seminar organised by the Responsible Art Market Initiative RAM a panel of experts answered questions from the floor about the new law.

Dealing with any property believing the property is proceeds of crime. The main goal of the KYC questionnaire update is to improve internal procedures and align it with the Anti Money Laundering AML and Know Your Client KYC policies effective in the European Union EU or other markets we are operating in. It is a process by which banks obtain information about the identity an 1. During the webinar we received many smart questions about automating AML. The 5th Anti-Money Laundering Directive provided a reference framework for KYC Know Your Customer processes in Europe and was scheduled to be implemented by Member States by 10 January 2020 aimed at tackling emerging issues and the funding of criminal activities.

Source: wisdomjobs.com

Source: wisdomjobs.com

Exam Code AML-KYC. Anti-Money laundering Interview Questions and Answers Q1What Is Money Laundering. Know your Customer KYC. IIBF AML-KYC Certification Registration Fees. 300 REAL TIME.

Source: qfs.munakkaboynton.pw

Source: qfs.munakkaboynton.pw

There are three stages involved in money laundering. There are three stages involved in money laundering. Number of Questions 120 Questions. Know your Customer KYC. Know your customer KYC KYC is the anti-money-laundering requirement on banks and other financial intermediaries to verify the identity and beneficial ownership of all their customers.

Exam Code AML-KYC. There are three stages involved in money laundering. 1500- For Non-Members Exam Language English. Why Do I Need To Perform Anti-money Laundering Checks. Non Members of IIBF.

Source: shuftipro.com

Source: shuftipro.com

IIBF AML-KYC Certification Registration Fees. KYC means Know Your Customer. 300 TOP ANTI MONEY LAUNDERING Interview Questions and Answers. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably. The Anti-Money Laundering regulations are governed by 4 Acts.

Source: workfusion.com

Source: workfusion.com

The objective of the KYC guidelines is to prevent banks being used intentionally or unintentionally by criminal elements for money laundering. At WorkFusion we work a lot with AML automation and banking automation in general so we are happy to answer some of the most interesting questions from the webinar here. The links between money laundering organized crime drug trafficking and terrorism pose a risk to financial institutions. It is a process by which banks obtain information about the identity an 1. Make money laundering a crime that is punishable by imprisonment Question 10 10.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kyc and anti money laundering questions and answers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information