15++ Kyc banking term ideas in 2021

Home » about money loundering Info » 15++ Kyc banking term ideas in 2021Your Kyc banking term images are available in this site. Kyc banking term are a topic that is being searched for and liked by netizens now. You can Find and Download the Kyc banking term files here. Find and Download all royalty-free images.

If you’re looking for kyc banking term pictures information related to the kyc banking term keyword, you have visit the right blog. Our site frequently gives you hints for refferencing the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

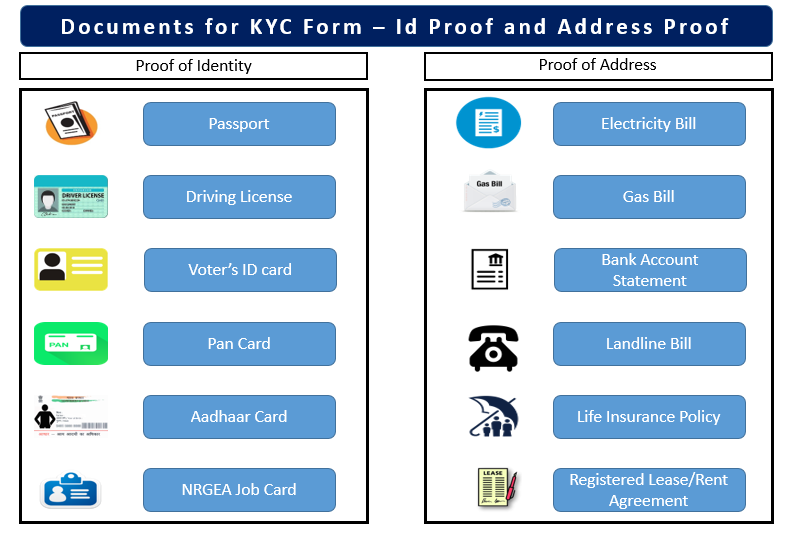

Kyc Banking Term. KYC or KYC check is the mandatory process of identifying and verifying the clients identity when opening an account and periodically over time. The intention behind the KYC. The impact is broad for customers and the mandates affect every institution that manages money. KYC full form is Know Your Customer which refers to the process of identity and addresses verification of all customers and clients by banks insurance companies and other institutions either before or while they are conducting transactions with their customers.

Kyc Full Form And Details Full Form From fullform.website

Kyc Full Form And Details Full Form From fullform.website

KYC means Know your customer is the process of a business identifying and verifying the identity of its clients. Oversight bodies across the globe have begun using mandates to bring digital identity verification and Know Your Customer to the forefront of the minds of businesses. The KYC Know-Your-Customer requirements to establish ie. The full form of KYC is Know Your Customer. The KYC requirements for individuals are as follows. KYC or Know Your Customer is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and individuals they do business with and ensures those entities are acting legallyEffective KYC protects companies from doing business with organisations or individuals involved in illegal activity such as money laundering terrorist financing.

KYC stands for Know Your Customer.

In other words banks must make sure. Banking and Financial services leader for ID and document verification. If the Customer Due Diligence CDD procedure and Full KYC is not completed within a yearin respect of deposit accounts the same shall be closed immediately. KYC is a term commonly used for customer identification process or these are the guidelines issued by the RBI and SEBI for financial institutions. The term is also used to refer to the bank regulation which governs these activities. The KYC requirements for individuals are as follows.

Source: paytah.com

Source: paytah.com

Banking is a highly-regulated industry and the government has been holding this sector to higher standards regarding Know Your Customer KYC laws. The KYC requirements for individuals are as follows. If the Customer Due Diligence CDD procedure and Full KYC is not completed within a yearin respect of deposit accounts the same shall be closed immediately. Know Your Customer or KYC is an important term used by businesses and refers to the process of verification of the identity of the customers and. The impact is broad for customers and the mandates affect every institution that manages money.

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

KYC in the banking sector involves bankers and advisors identifying their customers beneficial owners of businesses and the nature and purpose of customer relationships as well as reviewing. Customer Identification Program CIP Customer due diligence. Banking is a highly-regulated industry and the government has been holding this sector to higher standards regarding Know Your Customer KYC laws. To make your bank account KYC compliant you just have to follow the guidelines from the bank. The KYC Know-Your-Customer requirements to establish ie.

Source: straal.com

Source: straal.com

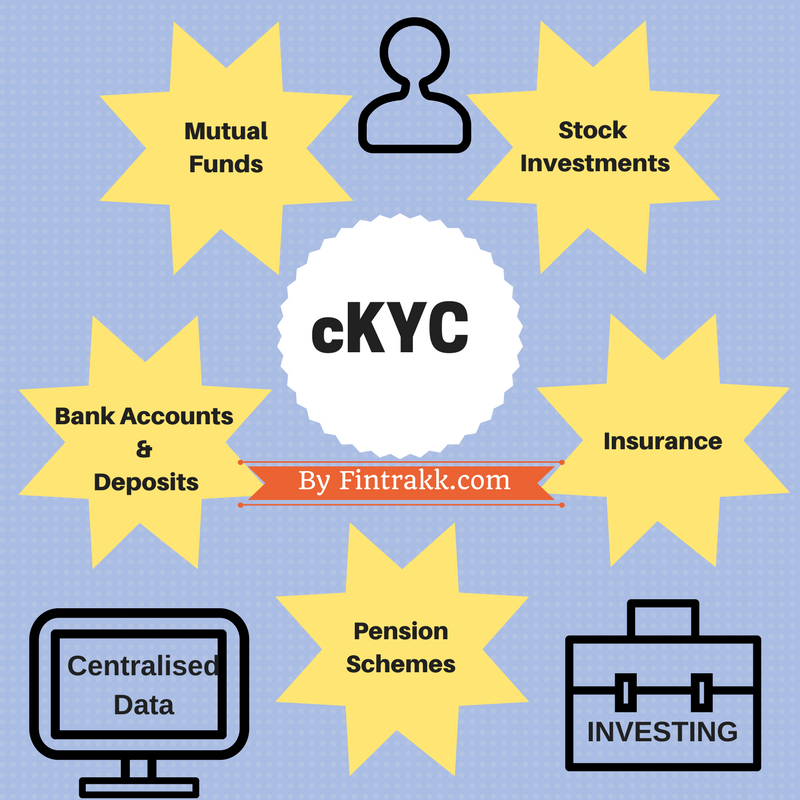

The full form of KYC is Know Your Customer. KYC or Know Your Customer is an identity verification process that all financial institutions perform to ensure fraudsters stay away from the company. To open a new bank account to keep a bank locker to open a mutual fund account and for different types of online investment your KYC must be updated with your Bank. KYCC refers to understanding deeper about the customers ie more granular level of. KYC stands for Know Your Customer.

Source: omatech.asia

Source: omatech.asia

Know Your Customer or KYC is an important term used by businesses and refers to the process of verification of the identity of the customers and. Banking and Financial services leader for ID and document verification. KYC or KYC check is the mandatory process of identifying and verifying the clients identity when opening an account and periodically over time. The term is also used to refer to the bank regulation which governs these activities. Validate information for individuals are set out in regulations 3 4 5 and 6 of FICA the Financial Intelligence Centre Act 38 of 2001.

Source: fincash.com

Source: fincash.com

KYC means Know Your Customer and sometimes Know Your Client. KYC means Know Your Customer and sometimes Know Your Client. KYC Know Your Customer is one of such requirements in which banks and other financial institutions have to adhere to certain guidelines for the verification identification and. KYC or Know Your Customer is an identity verification process that all financial institutions perform to ensure fraudsters stay away from the company. The impact is broad for customers and the mandates affect every institution that manages money.

Source: blog.privy.id

Source: blog.privy.id

KYCC refers to understanding deeper about the customers ie more granular level of. Limited KYC account has a validity of 365 days. The intention behind the KYC. The RBI sets the KYC rules for banks and other financial institutions in India. The term is also used to refer to the bank regulation which governs these activities.

Source: fullform.website

Source: fullform.website

Oversight bodies across the globe have begun using mandates to bring digital identity verification and Know Your Customer to the forefront of the minds of businesses. It is a common term used frequently by banking broking and other financial firms and companies for the formal procedure of obtaining all the information they can about the customer as volunteered by the customer themselves. The full form of KYC is Know Your Customer. KYC Know Your Customer is one of such requirements in which banks and other financial institutions have to adhere to certain guidelines for the verification identification and. In the United States KYC and AML mandates and their associated CDD requirements stem from the 1970 Bank Secrecy Act and the 2001 Patriot Act.

Source: fintrakk.com

Source: fintrakk.com

Limited KYC account has a validity of 365 days. KYC means Know your customer is the process of a business identifying and verifying the identity of its clients. The term is also used to refer to the bank regulation which governs these activities. Customer Identification Program CIP Customer due diligence. KYC in the banking sector involves bankers and advisors identifying their customers beneficial owners of businesses and the nature and purpose of customer relationships as well as reviewing.

Source: ppatk.go.id

Source: ppatk.go.id

It is a mandatory procedure in India that helps banks insurance companies and other financial institutions verify prospective customers addresses and identities before conducting transactions. Know Your Customer or KYC is an important term used by businesses and refers to the process of verification of the identity of the customers and. To make your bank account KYC compliant you just have to follow the guidelines from the bank. Validate information for individuals are set out in regulations 3 4 5 and 6 of FICA the Financial Intelligence Centre Act 38 of 2001. KYC in the banking sector involves bankers and advisors identifying their customers beneficial owners of businesses and the nature and purpose of customer relationships as well as reviewing.

Source: rndpoint.com

Source: rndpoint.com

KYC or Know Your Customer is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and individuals they do business with and ensures those entities are acting legallyEffective KYC protects companies from doing business with organisations or individuals involved in illegal activity such as money laundering terrorist financing. To open a new bank account to keep a bank locker to open a mutual fund account and for different types of online investment your KYC must be updated with your Bank. KYC or Know Your Customer is an identity verification process that all financial institutions perform to ensure fraudsters stay away from the company. KYCC refers to understanding deeper about the customers ie more granular level of. If the Customer Due Diligence CDD procedure and Full KYC is not completed within a yearin respect of deposit accounts the same shall be closed immediately.

Source: tookitaki.ai

Source: tookitaki.ai

Limited KYC account has a validity of 365 days. In other words banks must make sure. The RBI sets the KYC rules for banks and other financial institutions in India. Banking is a highly-regulated industry and the government has been holding this sector to higher standards regarding Know Your Customer KYC laws. It is a common term used frequently by banking broking and other financial firms and companies for the formal procedure of obtaining all the information they can about the customer as volunteered by the customer themselves.

Source: bbamantra.com

Source: bbamantra.com

The term is also used to refer to the bank regulation which governs these activities. Generally the KYC process works in three steps. Know Your Customer or KYC is an important term used by businesses and refers to the process of verification of the identity of the customers and. The intention behind the KYC. KYC or Know Your Customer is an identity verification process that all financial institutions perform to ensure fraudsters stay away from the company.

The intention behind the KYC. The full form of KYC is Know Your Customer. KYC in the banking sector involves bankers and advisors identifying their customers beneficial owners of businesses and the nature and purpose of customer relationships as well as reviewing. Obtain and verify ie. Customer Identification Program CIP Customer due diligence.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kyc banking term by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas