16++ Kyc guidelines ppt ideas

Home » about money loundering Info » 16++ Kyc guidelines ppt ideasYour Kyc guidelines ppt images are available in this site. Kyc guidelines ppt are a topic that is being searched for and liked by netizens today. You can Get the Kyc guidelines ppt files here. Find and Download all royalty-free photos.

If you’re searching for kyc guidelines ppt pictures information related to the kyc guidelines ppt topic, you have pay a visit to the ideal site. Our website always gives you hints for downloading the maximum quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

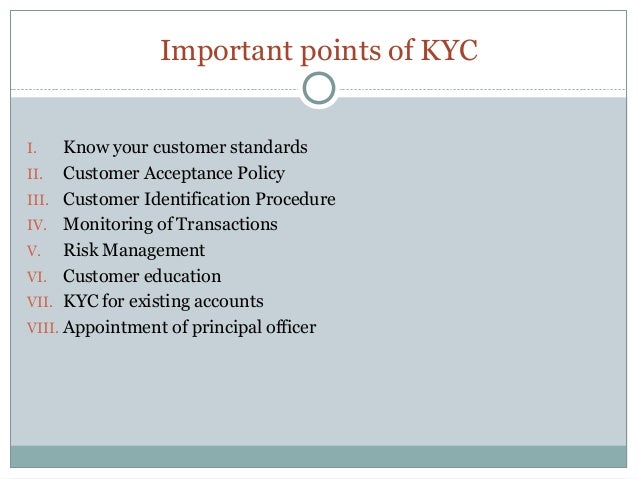

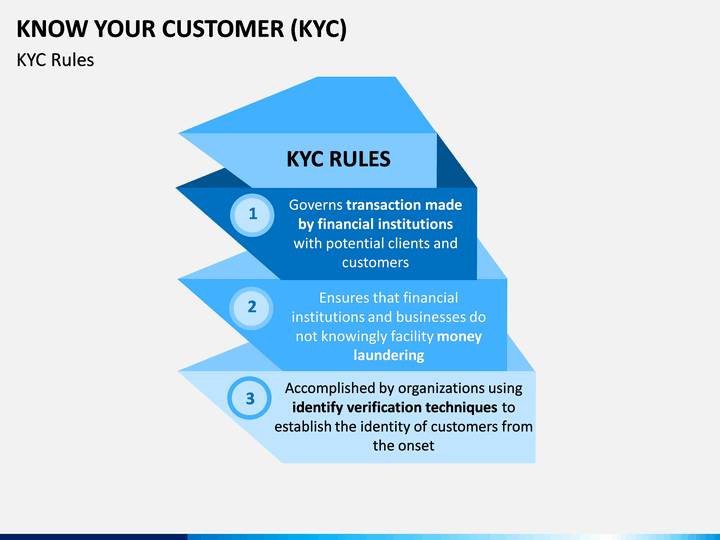

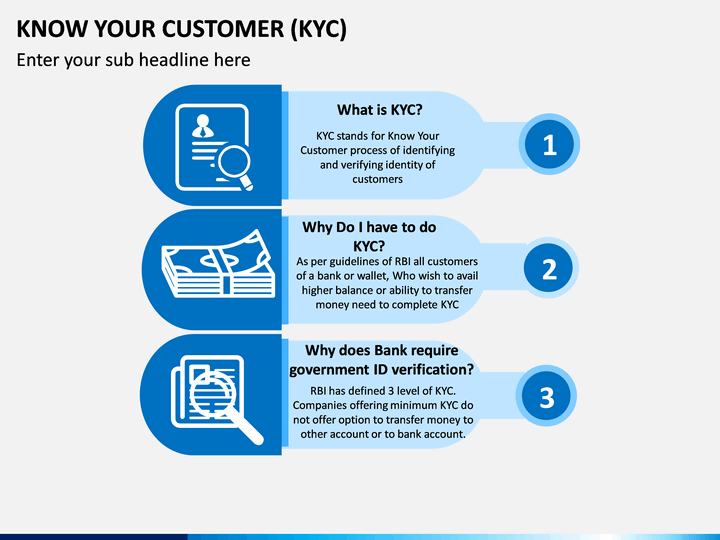

Kyc Guidelines Ppt. Know Your Customer and Transaction Monitoring and Investigations including the selection and use of enabling technology. Winner of the Standing Ovation Award for Best PowerPoint Templates from Presentations Magazine. If there would be any kind violation of the KYC norms by any bank it would be subject to penalty under the Bank Regulation Act 1949. KYC Policy According to the most recent RBI Guidelines for KYC Policy banks should frame their Know Your Customer policies incorporating the following four key elements.

Kyc Norms Aml Standards Guidelines Ppt Video Online Download From slideplayer.com

Kyc Norms Aml Standards Guidelines Ppt Video Online Download From slideplayer.com

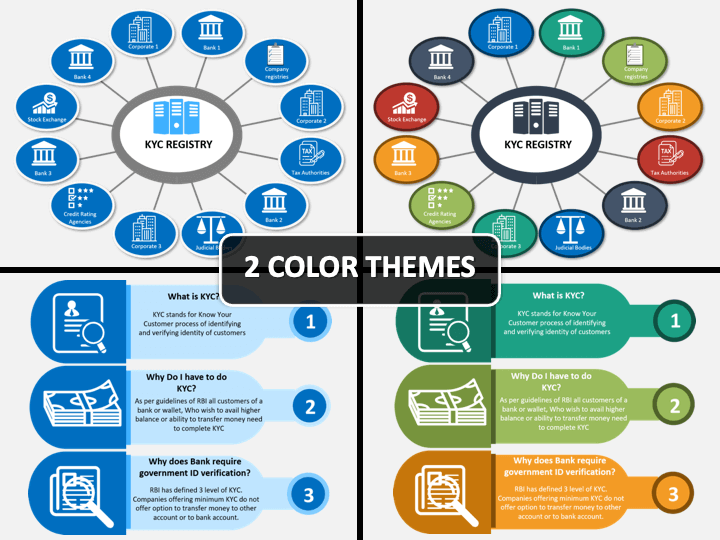

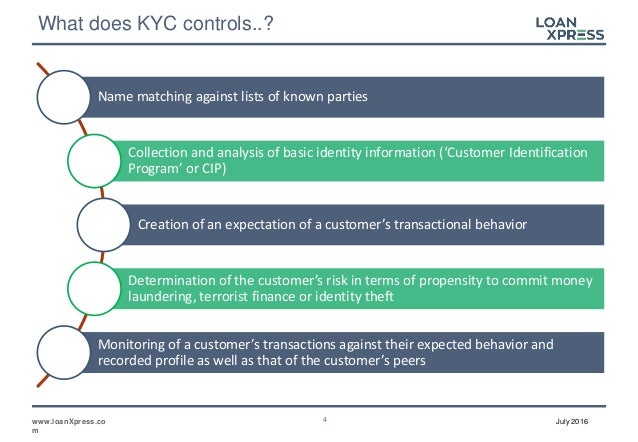

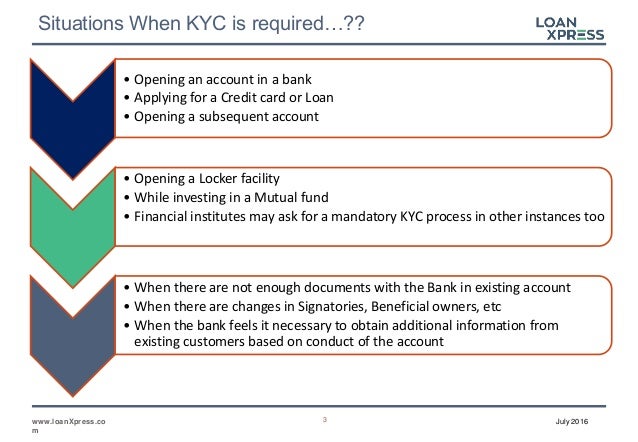

KYC for the Existing Accounts. Definition Know Your Customer is the process of verifying the identity of customer The objective of KYC guidelines is to prevent banks. Inappropriate implementation of AMLCFT regulations can play a role in excluding low income people from access to formal financial services Main challenge is typically the Know Your Customer KYC requirements But adherence to standards appropriately applied can help create confidence and sustainability in the system AMLCFT. KYC procedures also enable banks to knowunderstand their customers and their financial dealings better. The PowerPoint PPT presentation. Definition KYC Know Your Customer is a framework for banks which enables them to know understand the customers and their financial dealings to be able to serve them better All banks have been advised by The Reserve Bank of India RBI to follow certain KYC Guidelines Slide3.

The know your customer requirement doesnt stop after the account is opened.

The following minimum set of documents must be obtained from various types of customers account holder s. If there would be any kind violation of the KYC norms by any bank it would be subject to penalty under the Bank Regulation Act 1949. E-KYC Commodity Tatkal Account E-KYC Process Step 1 Fill the required details in Registration form and click on Submit E-KYC Process Step 2 After filling. Kyc Know Your Customer. KYC- Know Your Customer. Know Your Customer and Transaction Monitoring and Investigations including the selection and use of enabling technology.

Source: slideshare.net

Source: slideshare.net

Customer Acceptance Policy - classifying customers into risk categories high medium low b. KYC procedures also enable banks to knowunderstand their customers and their financial dealings better. KYC Policy Before opening any Deposit Ac Bank is required to carry out due diligence as required under Know Your Customer KYC guidelines issued by RBI and also in terms of the provisions of Prevention of Money-Laundering Act 2002 and the Prevention of. E Kyc Commodity Tatkal Account E Kyc Process Step 1 Fill The Required PPT. Inappropriate implementation of AMLCFT regulations can play a role in excluding low income people from access to formal financial services Main challenge is typically the Know Your Customer KYC requirements But adherence to standards appropriately applied can help create confidence and sustainability in the system AMLCFT.

Source: slideserve.com

Source: slideserve.com

Guidelines regarding Know Your Customer are issued by the RBI through Banking Regulation Act 1949 Section 35A along with Prevention of Money Laundering Maintenance of Records Rules 2005. Guidelines regarding Know Your Customer are issued by the RBI through Banking Regulation Act 1949 Section 35A along with Prevention of Money Laundering Maintenance of Records Rules 2005. Reserve Bank of India has advised banks to make theKnow Your Customer KYC procedures mandatorywhile opening and operating the accounts and hasissued the KYC guidelines under Section 35 A of theBanking Regulation Act 1949. Customer Acceptance Policy - classifying customers into risk categories high medium low b. KYC Compliance Process is.

Source: slideplayer.com

Source: slideplayer.com

Automate your KYC processes by defining the conditions for accepting or declining prospects. Inappropriate implementation of AMLCFT regulations can play a role in excluding low income people from access to formal financial services Main challenge is typically the Know Your Customer KYC requirements But adherence to standards appropriately applied can help create confidence and sustainability in the system AMLCFT. With the guidance and support of KYC3 you can enjoy the following benefits. Know Your Customer and Transaction Monitoring and Investigations including the selection and use of enabling technology. E Kyc Commodity Tatkal Account E Kyc Process Step 1 Fill The Required PPT.

Source: sketchbubble.com

Source: sketchbubble.com

Know Your Customer KYC Norms Guidelines The objective of KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money. Winner of the Standing Ovation Award for Best PowerPoint Templates from Presentations Magazine. Educate yourself understand the nbfc registration process and get necessary nbfc compliances done. KYC for the Existing Accounts. Any contravention of the same will attract penaltiesunder the relevant provisions of the Act.

Source: slideshare.net

Source: slideshare.net

E Kyc Commodity Tatkal Account E Kyc Process Step 1 Fill The Required PPT. Inappropriate implementation of AMLCFT regulations can play a role in excluding low income people from access to formal financial services Main challenge is typically the Know Your Customer KYC requirements But adherence to standards appropriately applied can help create confidence and sustainability in the system AMLCFT. Worlds Best PowerPoint Templates - CrystalGraphics offers more PowerPoint templates than anyone else in the world with over 4 million to choose from. The know your customer requirement doesnt stop after the account is opened. KYC Compliance Process is.

Source: slideplayer.com

Source: slideplayer.com

Reserve Bank of India has advised banks to make theKnow Your Customer KYC procedures mandatorywhile opening and operating the accounts and hasissued the KYC guidelines under Section 35 A of theBanking Regulation Act 1949. While each jurisdiction has its own KYB requirements here are four general steps to implement an effective program. Automate your KYC processes by defining the conditions for accepting or declining prospects. KYC- Know Your Customer. E-KYC Commodity Tatkal Account E-KYC Process Step 1 Fill the required details in Registration form and click on Submit E-KYC Process Step 2 After filling.

Source: sketchbubble.com

Source: sketchbubble.com

Know Your Customer KYC Norms Guidelines The objective of KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money. KYC Policy Before opening any Deposit Ac Bank is required to carry out due diligence as required under Know Your Customer KYC guidelines issued by RBI and also in terms of the provisions of Prevention of Money-Laundering Act 2002 and the Prevention of. KYC- Know Your Customer. KYC Compliance Process is. Definition Know Your Customer is the process of verifying the identity of customer The objective of KYC guidelines is to prevent banks.

Source: sketchbubble.com

Source: sketchbubble.com

Educate yourself understand the nbfc registration process and get necessary nbfc compliances done. KYC requirements to review for high-risk customers. Guidelines regarding Know Your Customer are issued by the RBI through Banking Regulation Act 1949 Section 35A along with Prevention of Money Laundering Maintenance of Records Rules 2005. Automate your KYC processes by defining the conditions for accepting or declining prospects. With the guidance and support of KYC3 you can enjoy the following benefits.

Source: slideplayer.com

Source: slideplayer.com

As specified by the Board of Governors of the Federal Reserve System when conducting EDD financial firms should review the below elements during the onboarding phase and also throughout the life of the relationship. The objective of KYC guidelines is to prevent banks from being used by criminal elements for money laundering activities. Be one step ahead of the regulations by knowing how to prove your KYC compliance correctly. Kyc Know Your Customer. Worlds Best PowerPoint Templates - CrystalGraphics offers more PowerPoint templates than anyone else in the world with over 4 million to choose from.

Source: slideshare.net

Source: slideshare.net

If there would be any kind violation of the KYC norms by any bank it would be subject to penalty under the Bank Regulation Act 1949. Customer Acceptance Policy - classifying customers into risk categories high medium low b. CKYC of NBFCs in India - NBFC registrations are often a cumbersome process when there is no guidance. Guidelines regarding Know Your Customer are issued by the RBI through Banking Regulation Act 1949 Section 35A along with Prevention of Money Laundering Maintenance of Records Rules 2005. KYC procedures also enable banks to knowunderstand their customers and their financial dealings better.

Source: slideserve.com

Source: slideserve.com

Winner of the Standing Ovation Award for Best PowerPoint Templates from Presentations Magazine. Kyc Know Your Customer. Objectives To enable the Bank to have positive identification of its relationship Is in the. Make faster KYC decisions for each prospective customer or partner organisation. Reserve Bank of India has advised banks to make theKnow Your Customer KYC procedures mandatorywhile opening and operating the accounts and hasissued the KYC guidelines under Section 35 A of theBanking Regulation Act 1949.

Source: slideplayer.com

Source: slideplayer.com

Definition Know Your Customer is the process of verifying the identity of customer The objective of KYC guidelines is to prevent banks. KYC- Know Your Customer. KYC Guidelines All reasonable efforts shall be made to determine true identity of every prospective customer. Definition Know Your Customer is the process of verifying the identity of customer The objective of KYC guidelines is to prevent banks. Identify and verify an accurate company record such as information regarding register number company name.

Source: sketchbubble.com

Source: sketchbubble.com

KYC requirements to review for high-risk customers. Kyc Know Your Customer. As specified by the Board of Governors of the Federal Reserve System when conducting EDD financial firms should review the below elements during the onboarding phase and also throughout the life of the relationship. While each jurisdiction has its own KYB requirements here are four general steps to implement an effective program. KYC Policy Before opening any Deposit Ac Bank is required to carry out due diligence as required under Know Your Customer KYC guidelines issued by RBI and also in terms of the provisions of Prevention of Money-Laundering Act 2002 and the Prevention of.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kyc guidelines ppt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas