14++ Kyc money laundering regulations uk information

Home » about money loundering Info » 14++ Kyc money laundering regulations uk informationYour Kyc money laundering regulations uk images are ready in this website. Kyc money laundering regulations uk are a topic that is being searched for and liked by netizens today. You can Download the Kyc money laundering regulations uk files here. Download all free images.

If you’re searching for kyc money laundering regulations uk images information linked to the kyc money laundering regulations uk keyword, you have come to the ideal blog. Our site always gives you hints for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

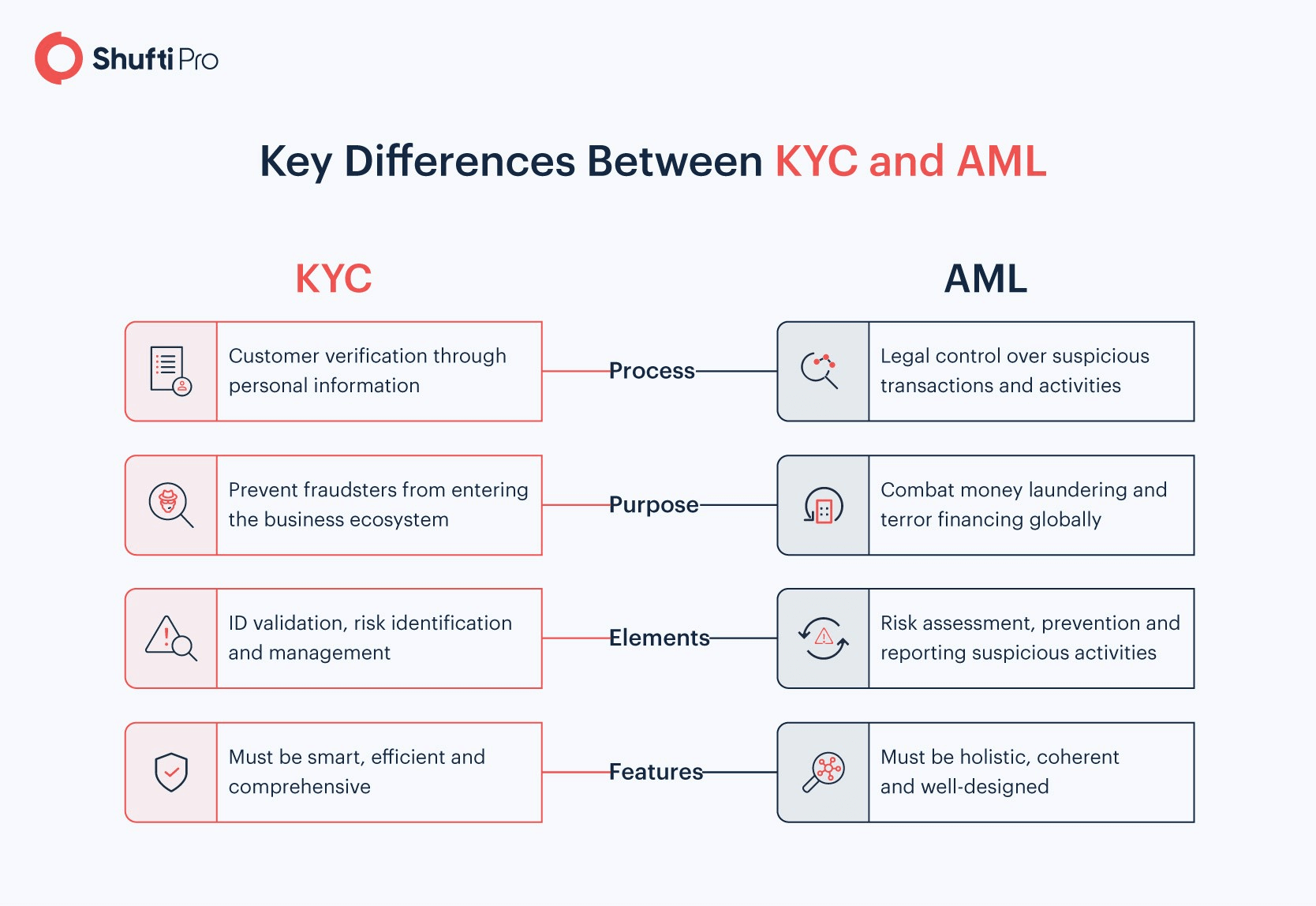

Kyc Money Laundering Regulations Uk. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to assist firms operating. An AML check should include Know Your Customer KYC procedures so you can prove you know who you are dealing with. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options.

What Are Exactly Kyc And Ekyc Meaning In Banking Know Your Customer Cryptocurrency Big Data Technologies From pinterest.com

What Are Exactly Kyc And Ekyc Meaning In Banking Know Your Customer Cryptocurrency Big Data Technologies From pinterest.com

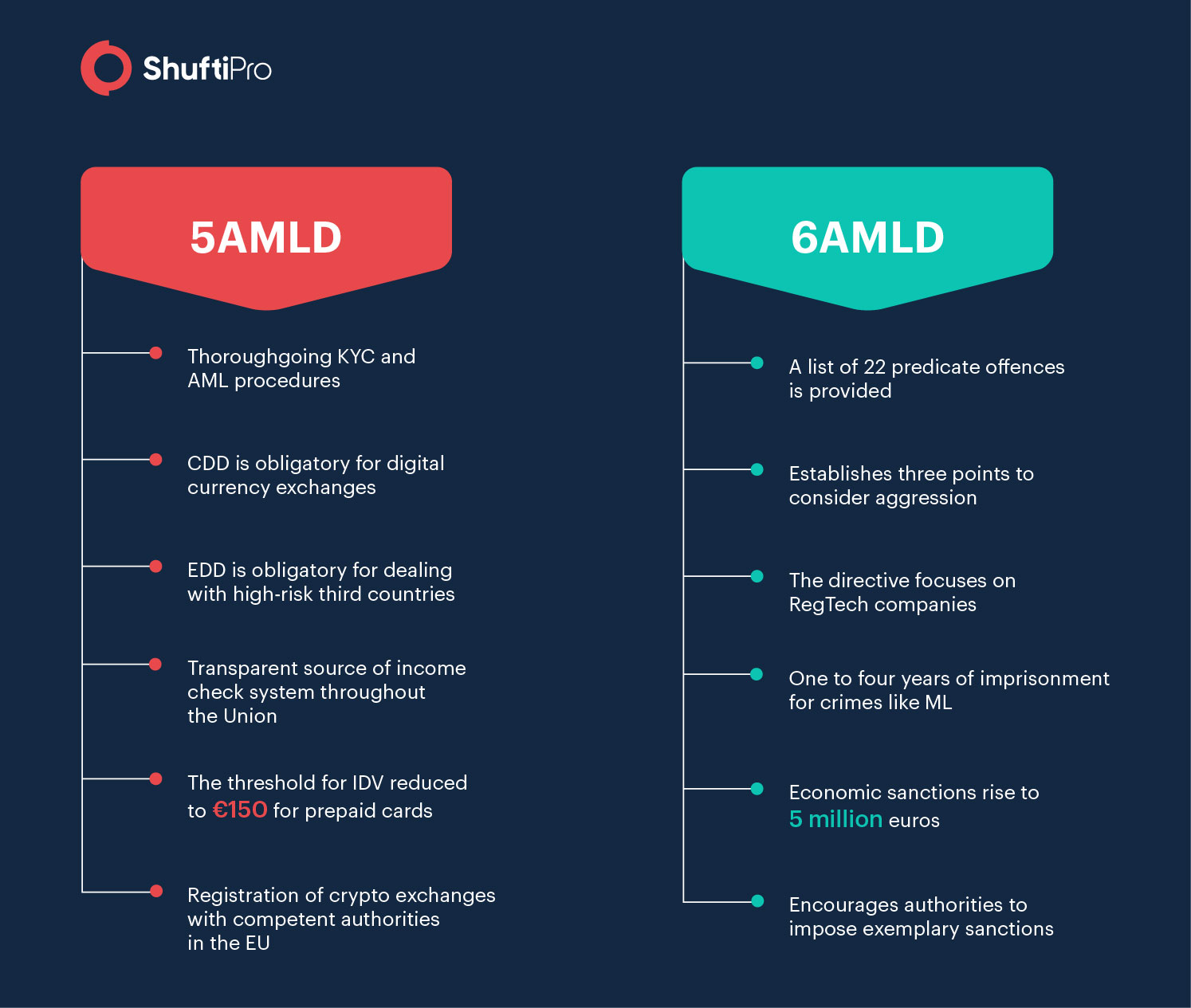

Banks in the UK are required by law to comply with anti-money laundering AML laws and Know your Customer KYC requirements to prevent criminals and terrorists from using financial products or services to store and move around their money. This legislation extends the scope of regulated industries and changes the way customer. Officials are by law unable to fine banks or corporations for accepting laundered funds and must go after individuals instead making it difficult to create long-lasting change. The Money Laundering and Terrorist Financing Regulations 2019 implemented the EU Fifth Money Laundering Directive in the UK and came into effect on 10 January 2020. The US and UK anti-money laundering laws and regulations compare favourably in that both regimes stipulate extensive regulatory requirements for. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options.

58 AML fines were.

Banks in the UK are required by law to comply with anti-money laundering AML laws and Know your Customer KYC requirements to prevent criminals and terrorists from using financial products or services to store and move around their money. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is. Officials are by law unable to fine banks or corporations for accepting laundered funds and must go after individuals instead making it difficult to create long-lasting change. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options. This legislation extends the scope of regulated industries and changes the way customer. Consultation on draft regulations and response to previous consultation on transposing the Fourth Money Laundering Directive and Fund Transfer Regulation.

Source: softelligence.net

Source: softelligence.net

Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options. Among all the states the United Kingdom has the most robust KYC and AML regulations. An AML check should include Know Your Customer KYC procedures so you can prove you know who you are dealing with. Consultation on draft regulations and response to previous consultation on transposing the Fourth Money Laundering Directive and Fund Transfer Regulation. This legislation extends the scope of regulated industries and changes the way customer.

Source: pinterest.com

Source: pinterest.com

The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is. Namely companies must continue to meet national and EU Anti-Money Laundering AML and Know Your Customer KYC regulations. The UKs strict and money laundering regulations aim to detect financial crimes and anti-money laundering. Virtual Currency Exchange Platforms. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options.

In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to assist firms operating. In the UK these requirements come mainly from the Money Laundering Regulations Act 2007 and apply across a range of sectors and institutions. The UKs strict and money laundering regulations aim to detect financial crimes and anti-money laundering. The Money Laundering and Terrorist Financing Regulations 2019 implemented the EU Fifth Money Laundering Directive in the UK and came into effect on 10 January 2020. In 2017 The Joint Money Laundering Steering Group JMLSG which sets the regulatory guidance for all UK financial services firms issued revised KYC guidanceThis ensures that United Kingdom regulations remain in line with recent updates from the Financial Action Task Force FATF and the European Union Fourth Money Laundering DirectiveThis revised guidance places a particular.

Source: pinterest.com

Source: pinterest.com

Officials are by law unable to fine banks or corporations for accepting laundered funds and must go after individuals instead making it difficult to create long-lasting change. Namely companies must continue to meet national and EU Anti-Money Laundering AML and Know Your Customer KYC regulations. Banks in the UK are required by law to comply with anti-money laundering AML laws and Know your Customer KYC requirements to prevent criminals and terrorists from using financial products or services to store and move around their money. An AML check should include Know Your Customer KYC procedures so you can prove you know who you are dealing with. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options.

Source: nl.pinterest.com

Source: nl.pinterest.com

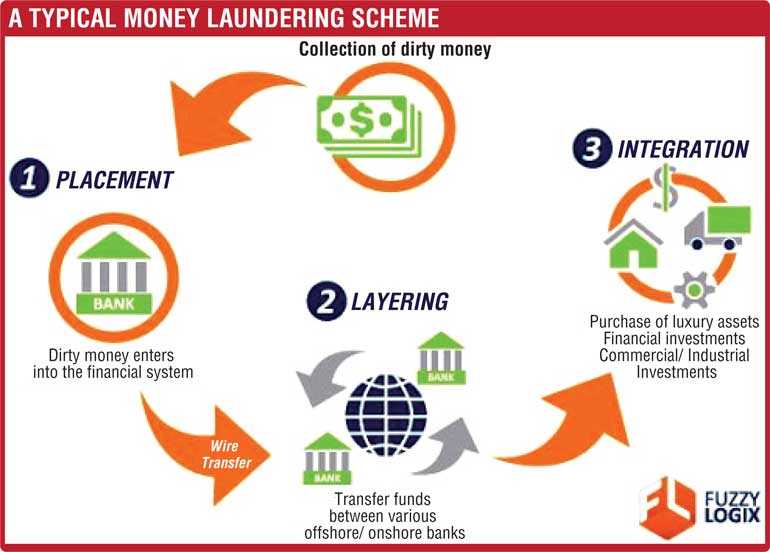

On the 10th January 2020 the UK transposed the EUs 5th Anti Money Laundering Directive 5MLD into domestic law via the Money Laundering and Terrorist Financing Amendment Regulations 2019 the 2019 Regulations updating the 2017 Regulations and extending the scope of persons subject to anti-money laundering laws to include. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options. An Anti-Money Laundering check is a process your business needs to undertake to prevent Money Laundering activity. The US and UK anti-money laundering laws and regulations compare favourably in that both regimes stipulate extensive regulatory requirements for. Namely companies must continue to meet national and EU Anti-Money Laundering AML and Know Your Customer KYC regulations.

Source: shuftipro.com

Source: shuftipro.com

In 2017 The Joint Money Laundering Steering Group JMLSG which sets the regulatory guidance for all UK financial services firms issued revised KYC guidanceThis ensures that United Kingdom regulations remain in line with recent updates from the Financial Action Task Force FATF and the European Union Fourth Money Laundering DirectiveThis revised guidance places a particular. For the same reason it is also known as the Global Leader in promoting corporate transparency by the Financial Actions Task Force FATF. An AML check involves identity checks and verification plus monitoring of financial transactions to detect fraud. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options. 58 AML fines were.

Source: ft.lk

Source: ft.lk

The Money Laundering and Terrorist Financing Regulations 2019 implemented the EU Fifth Money Laundering Directive in the UK and came into effect on 10 January 2020. Virtual Currency Exchange Platforms. An Anti-Money Laundering check is a process your business needs to undertake to prevent Money Laundering activity. With our global AI powered solution verify user ID Passports drivings licenses instantly. While an EU member state UK-based companies simply had to demonstrate compliance by following and adhering to EU AML and KYC regulations and law even passporting into the EU.

Source: id.pinterest.com

Source: id.pinterest.com

In 2017 The Joint Money Laundering Steering Group JMLSG which sets the regulatory guidance for all UK financial services firms issued revised KYC guidanceThis ensures that United Kingdom regulations remain in line with recent updates from the Financial Action Task Force FATF and the European Union Fourth Money Laundering DirectiveThis revised guidance places a particular. Among all the states the United Kingdom has the most robust KYC and AML regulations. With our global AI powered solution verify user ID Passports drivings licenses instantly. While an EU member state UK-based companies simply had to demonstrate compliance by following and adhering to EU AML and KYC regulations and law even passporting into the EU. Oversight and that Anti Money Laundering AML regulatory requirements are being adhered to at both a local and global level.

Source: pinterest.com

Source: pinterest.com

An AML check should include Know Your Customer KYC procedures so you can prove you know who you are dealing with. An Anti-Money Laundering check is a process your business needs to undertake to prevent Money Laundering activity. With our global AI powered solution verify user ID Passports drivings licenses instantly. This legislation extends the scope of regulated industries and changes the way customer. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to assist firms operating.

Source: pinterest.com

Source: pinterest.com

While an EU member state UK-based companies simply had to demonstrate compliance by following and adhering to EU AML and KYC regulations and law even passporting into the EU. The US and UK anti-money laundering laws and regulations compare favourably in that both regimes stipulate extensive regulatory requirements for. For the same reason it is also known as the Global Leader in promoting corporate transparency by the Financial Actions Task Force FATF. In 2017 The Joint Money Laundering Steering Group JMLSG which sets the regulatory guidance for all UK financial services firms issued revised KYC guidanceThis ensures that United Kingdom regulations remain in line with recent updates from the Financial Action Task Force FATF and the European Union Fourth Money Laundering DirectiveThis revised guidance places a particular. An AML check involves identity checks and verification plus monitoring of financial transactions to detect fraud.

Source: pinterest.com

Source: pinterest.com

Namely companies must continue to meet national and EU Anti-Money Laundering AML and Know Your Customer KYC regulations. Among all the states the United Kingdom has the most robust KYC and AML regulations. With our global AI powered solution verify user ID Passports drivings licenses instantly. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to assist firms operating. Virtual Currency Exchange Platforms.

Source: shuftipro.com

Source: shuftipro.com

Oversight and that Anti Money Laundering AML regulatory requirements are being adhered to at both a local and global level. Virtual Currency Exchange Platforms. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is. In 2017 The Joint Money Laundering Steering Group JMLSG which sets the regulatory guidance for all UK financial services firms issued revised KYC guidanceThis ensures that United Kingdom regulations remain in line with recent updates from the Financial Action Task Force FATF and the European Union Fourth Money Laundering DirectiveThis revised guidance places a particular. An Anti-Money Laundering check is a process your business needs to undertake to prevent Money Laundering activity.

Source: ing.com

Source: ing.com

In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to assist firms operating. 58 AML fines were. With our global AI powered solution verify user ID Passports drivings licenses instantly. An AML check should include Know Your Customer KYC procedures so you can prove you know who you are dealing with. This legislation extends the scope of regulated industries and changes the way customer.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kyc money laundering regulations uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas