17+ Kyc process flow in banks ideas

Home » about money loundering Info » 17+ Kyc process flow in banks ideasYour Kyc process flow in banks images are ready in this website. Kyc process flow in banks are a topic that is being searched for and liked by netizens today. You can Find and Download the Kyc process flow in banks files here. Get all royalty-free images.

If you’re searching for kyc process flow in banks images information connected with to the kyc process flow in banks interest, you have come to the ideal blog. Our site frequently provides you with hints for viewing the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

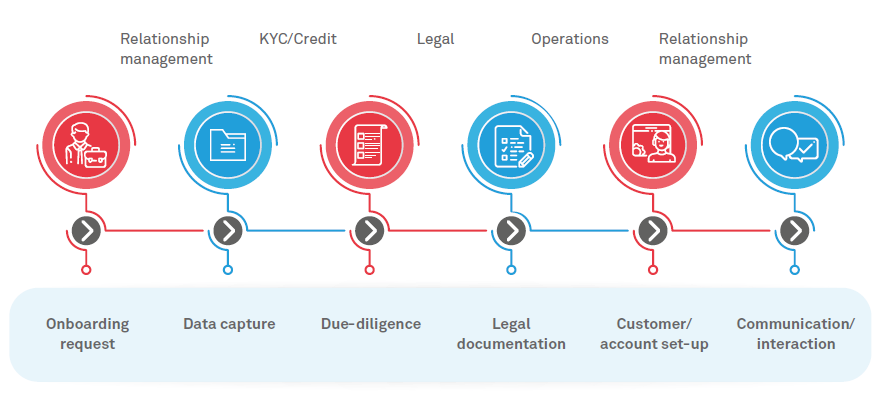

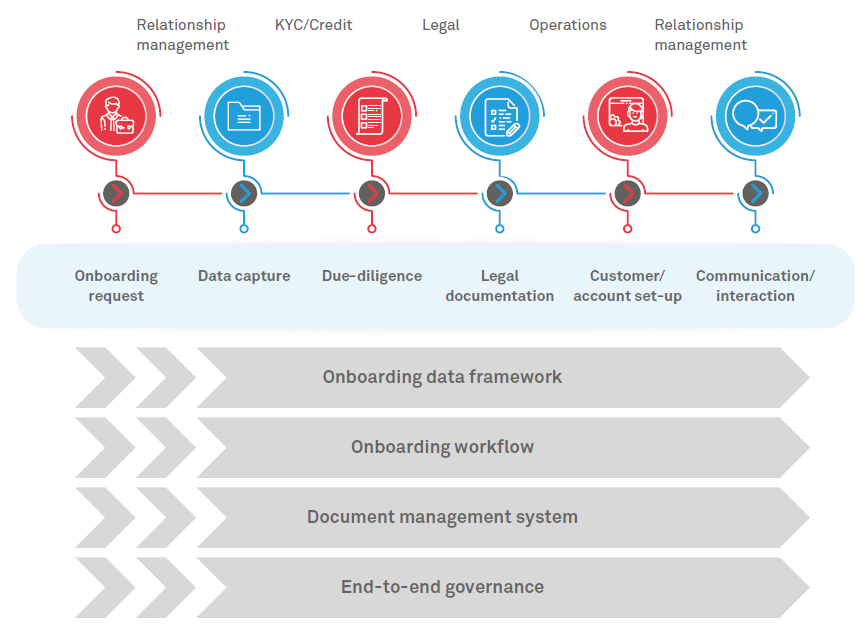

Kyc Process Flow In Banks. Set up a compliance unit with a full time Head. Why is the KYC process important. In addressing these pre-requisites up front we minimise time and cost and help ensure a successful end-to-end project. Just like the way traditional banking institutions were used to verify an identity online KYC verification is performed.

Lapith On Twitter Strategic Options Change Management Challenges And Opportunities From pinterest.com

Lapith On Twitter Strategic Options Change Management Challenges And Opportunities From pinterest.com

KYC KYCCustomer due diligence is an on-going process for prudent banking practices therefore the banks are encouraged to. KYC Verification Process Steps. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. You must document the customer identification procedures you use for different types of customers. KYCAML compliance processes focus on developing an accurate customer risk profile supporting fraud identification and conducting ongoing account monitoring.

The verification to be carried out by the Banks shall be a simple two-step process.

The flows frequently relied on easily-falsified proof of residence documents to confirm a customers. Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers. Banks are also required to periodically update their customers KYC details. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. As per the defined process once. It is a process by which banks obtain information about the identity and address of the customers.

Source: in.pinterest.com

Source: in.pinterest.com

The Know Your Client KYC or Know Your Customer KYC is a process to verify the identity and other credentials of a financial services user. Put in place a system to monitor the accounts and transactions on a regular basis. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Just like the way traditional banking institutions were used to verify an identity online KYC verification is performed. The KYC procedure is used when bank customers open accounts.

Source: wipro.com

Source: wipro.com

Identifying and verifying the identity of customers. Know Your Customer KYC regulations are a critical component to anti-money laundering efforts. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. Since the passing of the Patriot Act KYC processes. Just like the way traditional banking institutions were used to verify an identity online KYC verification is performed.

Source: pinterest.com

Source: pinterest.com

Why is the KYC process important. KYC includes knowing an individual acting on behalf of an organization In 2016 the US. KYC is a regulatory process of ascertaining the identity and other information of a financial services user. This process helps to ensure that banks services are not misused. Process at Bank for KYC Verification under NPS The Banks functioning as POP in NPS - play a pivotal role in enabling the subscriber to get hisher KYC verification done for their PRANs generated under eNPS.

Source: pinterest.com

Source: pinterest.com

If after completing the process of KYC and AMI evaluation of the customer the application poses too much of a risk then the next process is for the chief AML lead or compliance lead to. The KYC Process Undertaken by Banks Financial Institutions. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. The KYC procedure is used when bank customers open accounts. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures.

Source: in.pinterest.com

Source: in.pinterest.com

Account opening is the final phase in the KYC onboarding lifecycle process flow. In order to clarify and strengthen CDD requirements and meet KYC in the financial sector the FinCEN outlined four minimum elements needed for an effective KYC procedure. Put in place a system to monitor the accounts and transactions on a regular basis. The goal of KYC is to prevent banks from being used intentionally or. If after completing the process of KYC and AMI evaluation of the customer the application poses too much of a risk then the next process is for the chief AML lead or compliance lead to.

Source: pinterest.com

Source: pinterest.com

As per the defined process once. KYC KYCCustomer due diligence is an on-going process for prudent banking practices therefore the banks are encouraged to. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. Put in place a system to monitor the accounts and transactions on a regular basis. Process at Bank for KYC Verification under NPS The Banks functioning as POP in NPS - play a pivotal role in enabling the subscriber to get hisher KYC verification done for their PRANs generated under eNPS.

Source: pinterest.com

Source: pinterest.com

The flows frequently relied on easily-falsified proof of residence documents to confirm a customers. The KYC procedure is used when bank customers open accounts. The KYC procedure is to be completed by the banks while. The flows frequently relied on easily-falsified proof of residence documents to confirm a customers. Know Your Customer KYC regulations are a critical component to anti-money laundering efforts.

Source: pinterest.com

Source: pinterest.com

Know Your Customer or KYC is the process by which banks and financial institutions verify the identities of their clients and assess any potential risks of forming a business relationship with them. The KYC procedure is to be completed by the banks while. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. Banks are also required to periodically update their customers KYC details. Since the passing of the Patriot Act KYC processes.

Source: in.pinterest.com

Source: in.pinterest.com

Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers. Identifying and verifying the identity of customers. Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. KYC stands for Know Your Customer It is a process where banks obtain information about their customers identity thereby ensuring that bank services and government regulations not misused.

Source: wipro.com

Source: wipro.com

KYC verification process steps include. KYC means Know Your Customer. Process at Bank for KYC Verification under NPS The Banks functioning as POP in NPS - play a pivotal role in enabling the subscriber to get hisher KYC verification done for their PRANs generated under eNPS. KYC Verification Process Steps. The KYC Process Undertaken by Banks Financial Institutions.

Source: pinterest.com

Source: pinterest.com

KYC Flow offers flexible CDD templates to establish and test workflow processes governance and escalation channels. The Know Your Client KYC process. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. Why is the KYC process important. KYC procedures defined by banks involve all the necessary actions to ensure their customers are real assess and monitor risks.

Source: pinterest.com

Source: pinterest.com

The Know Your Client KYC process. Process at Bank for KYC Verification under NPS The Banks functioning as POP in NPS - play a pivotal role in enabling the subscriber to get hisher KYC verification done for their PRANs generated under eNPS. Know Your Customer KYC regulations are a critical component to anti-money laundering efforts. Since the passing of the Patriot Act KYC processes. KYC Flow offers flexible CDD templates to establish and test workflow processes governance and escalation channels.

Source: wipro.com

Source: wipro.com

This process helps to ensure that banks services are not misused. Government issued a rule requiring banks to verify the identities of beneficial owners of legal entity clients such as corporations LLCs partnerships unincorporated non-profits and statutory trusts. 2 Configure data sources APIs for case auto-population. In addressing these pre-requisites up front we minimise time and cost and help ensure a successful end-to-end project. KYC is a regulatory process of ascertaining the identity and other information of a financial services user.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title kyc process flow in banks by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas