14++ Kycaml legal requirements info

Home » about money loundering Info » 14++ Kycaml legal requirements infoYour Kycaml legal requirements images are available. Kycaml legal requirements are a topic that is being searched for and liked by netizens now. You can Find and Download the Kycaml legal requirements files here. Download all free photos and vectors.

If you’re searching for kycaml legal requirements images information related to the kycaml legal requirements interest, you have pay a visit to the ideal site. Our site frequently gives you suggestions for seeing the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

Kycaml Legal Requirements. The reason why mobile KYC is coming in handy for banks to authentic transactions and account opening. AML compliance is a lot more comprehensive and actually includes KYC compliance as one of its requirements. The directive is regularly updated in order to cope with the latest compliance landscape. All BaFins AML requirements as well as administrative fines for non-compliance come from this primary AML law in Germany.

Record Breaking Fines On Banks For Kyc Aml Non Compliance From shuftipro.com

Record Breaking Fines On Banks For Kyc Aml Non Compliance From shuftipro.com

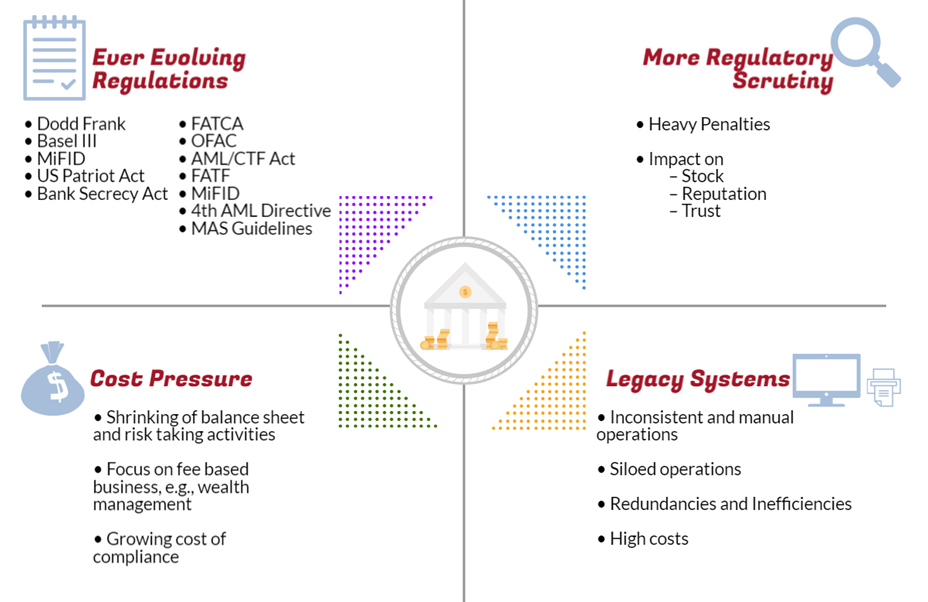

A KYCAML regulation is basically a framework that is intended to assist different business sectors across the globe. Law firms need to up their game with regards to Know Your Customer KYC and Anti-Money Laundering AML requirements as the Solicitors Regulation Authority announced that it would be checking in on all 7000 firms that come under the scope of the regulations. Ad AML coverage from every angle. The Sixth Anti-Money Laundering Directive 6AMLD is being launched to replace 5AMLD and 4AMLD. Latest news reports from the medical literature videos from the experts and more. This requirement has now been extended to Corporations like HowToPay that handle Payments and Financial services.

Regulations around the globe are changing due to technological advances financial institutions are bound to follow the guidelines for AML and are required to follow Know your customer checks for remote customer identification.

A KYCAML regulation is basically a framework that is intended to assist different business sectors across the globe. The reason why mobile KYC is coming in handy for banks to authentic transactions and account opening. All BaFins AML requirements as well as administrative fines for non-compliance come from this primary AML law in Germany. The Act aligns with the 4th and 5th Anti-Money Laundering Directives that regulate AML compliance in all spheres throughout the European Union. The term Anti-Money Laundering or AML refers to a set of procedures and legal regulations that are in place to identify and prevent profit from illegal activities. No KYC requirements have always been an industry standard.

Source: getmati.com

Source: getmati.com

This requirement has now been extended to Corporations like HowToPay that handle Payments and Financial services. AML compliance is a lot more comprehensive and actually includes KYC compliance as one of its requirements. This covers such pursuits as trading illegal goods evading tax manipulating markets and laundering ill-gotten funds. KYC and AML obligations are nothing new to the legal sector. The Sixth Anti-Money Laundering Directive 6AMLD is being launched to replace 5AMLD and 4AMLD.

Source: processmaker.com

Source: processmaker.com

The responses to the questions have been drawn from myriad regulatory publications issuances and guidance from other. The directive is regularly updated in order to cope with the latest compliance landscape. AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. Any time a company is established or wishes to sign a contract or work officially with another company there is a legal requirement for some form of KYC or identity verification to take place to ensure that business is being conducted in accordance with the regulations and guidelines. Law firms need to up their game with regards to Know Your Customer KYC and Anti-Money Laundering AML requirements as the Solicitors Regulation Authority announced that it would be checking in on all 7000 firms that come under the scope of the regulations.

Source: tookitaki.ai

Source: tookitaki.ai

The Anti Money Laundering Directive AMLD is established to fight against money laundering typologies terrorist financing across EU regions. The directive is regularly updated in order to cope with the latest compliance landscape. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. The Sixth Anti-Money Laundering Directive 6AMLD is being launched to replace 5AMLD and 4AMLD. The Banking Act supervises financial institutions in the country.

Source: medium.com

Source: medium.com

Any time a company is established or wishes to sign a contract or work officially with another company there is a legal requirement for some form of KYC or identity verification to take place to ensure that business is being conducted in accordance with the regulations and guidelines. No KYC requirements have always been an industry standard. The reason why mobile KYC is coming in handy for banks to authentic transactions and account opening. Regulations around the globe are changing due to technological advances financial institutions are bound to follow the guidelines for AML and are required to follow Know your customer checks for remote customer identification. The Banking Act supervises financial institutions in the country.

Source: bi.go.id

Source: bi.go.id

This covers such pursuits as trading illegal goods evading tax manipulating markets and laundering ill-gotten funds. Latest news reports from the medical literature videos from the experts and more. KYC and AML obligations are nothing new to the legal sector. No KYC requirements have always been an industry standard. The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose.

Bad actors tend to pretend someone else. The Act aligns with the 4th and 5th Anti-Money Laundering Directives that regulate AML compliance in all spheres throughout the European Union. The Sixth Anti-Money Laundering Directive 6AMLD is being launched to replace 5AMLD and 4AMLD. You must document the customer identification procedures you use for different types of customers. Regulations around the globe are changing due to technological advances financial institutions are bound to follow the guidelines for AML and are required to follow Know your customer checks for remote customer identification.

Source: shuftipro.com

Source: shuftipro.com

It is not intended to be legal analysis or advice nor does it purport to address except in a few instances state or international money laundering requirements that may affect US. A KYCAML regulation is basically a framework that is intended to assist different business sectors across the globe. AMLKYC regulations require banks and other financial institutions such as trust companies insurance companies and brokerage firms to understand who their customers are and what type of transactions they perform. Regulations around the globe are changing due to technological advances financial institutions are bound to follow the guidelines for AML and are required to follow Know your customer checks for remote customer identification. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures.

Source: sdk.finance

Source: sdk.finance

Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. The directive is regularly updated in order to cope with the latest compliance landscape. A KYCAML regulation is basically a framework that is intended to assist different business sectors across the globe. In the United States KYCAML requirements are dictated by the Bank Secrecy Act BSA the PATRIOT Act and the Office of Foreign Assets Control OFAC. The Anti Money Laundering Directive AMLD is established to fight against money laundering typologies terrorist financing across EU regions.

Source: shuftipro.com

Source: shuftipro.com

AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. You must document the customer identification procedures you use for different types of customers. In the United States KYCAML requirements are dictated by the Bank Secrecy Act BSA the PATRIOT Act and the Office of Foreign Assets Control OFAC. AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. Regulations around the globe are changing due to technological advances financial institutions are bound to follow the guidelines for AML and are required to follow Know your customer checks for remote customer identification.

Source: shuftipro.com

Source: shuftipro.com

This requirement has now been extended to Corporations like HowToPay that handle Payments and Financial services. The Bank Secrecy Act requires financial institutions to provide internal controls ensuring compliance provide independent compliance testing designate an individual responsible for ensuring compliance and provide compliance training. The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose. AMLKYC regulations require banks and other financial institutions such as trust companies insurance companies and brokerage firms to understand who their customers are and what type of transactions they perform. KYC and AML obligations are nothing new to the legal sector.

Source: sfl.global

Source: sfl.global

The Bank Secrecy Act requires financial institutions to provide internal controls ensuring compliance provide independent compliance testing designate an individual responsible for ensuring compliance and provide compliance training. When banks and certain other financial institutions open accounts for entities among other anti-money laundering AML customer identification requirements they must obtain beneficial ownership information on individuals owning 25 or more of the entity and a person with significant control over the entity such as a president or chief executive officer. The responses to the questions have been drawn from myriad regulatory publications issuances and guidance from other. The Bank Secrecy Act requires financial institutions to provide internal controls ensuring compliance provide independent compliance testing designate an individual responsible for ensuring compliance and provide compliance training. Any time a company is established or wishes to sign a contract or work officially with another company there is a legal requirement for some form of KYC or identity verification to take place to ensure that business is being conducted in accordance with the regulations and guidelines.

Source: medium.com

Source: medium.com

The main aim of this KYC and AML regulation is to combat various fraudulent activities like online money laundering identity theft and terrorist financing. Ad AML coverage from every angle. The Sixth Anti-Money Laundering Directive 6AMLD is being launched to replace 5AMLD and 4AMLD. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. The main aim of this KYC and AML regulation is to combat various fraudulent activities like online money laundering identity theft and terrorist financing.

Source: bi.go.id

Source: bi.go.id

In the United States KYCAML requirements are dictated by the Bank Secrecy Act BSA the PATRIOT Act and the Office of Foreign Assets Control OFAC. Ad AML coverage from every angle. The main aim of this KYC and AML regulation is to combat various fraudulent activities like online money laundering identity theft and terrorist financing. Bad actors tend to pretend someone else. No KYC requirements have always been an industry standard.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kycaml legal requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas