19+ Laundering meaning banking info

Home » about money loundering Info » 19+ Laundering meaning banking infoYour Laundering meaning banking images are ready in this website. Laundering meaning banking are a topic that is being searched for and liked by netizens now. You can Get the Laundering meaning banking files here. Find and Download all royalty-free vectors.

If you’re looking for laundering meaning banking pictures information linked to the laundering meaning banking interest, you have come to the ideal blog. Our site always provides you with suggestions for downloading the maximum quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

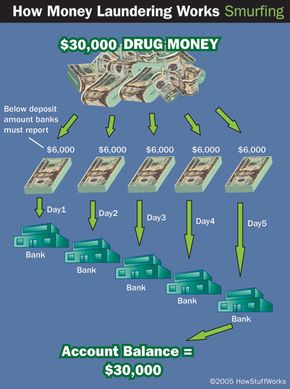

Laundering Meaning Banking. Money Laundering meaning in law. The methods used to launder money are similar whether its for white-collar crimes such as tax evasion peopledrug trafficking or. The main reason for money laundering is to clean illegal money in a convenient manner which gradually mixing it with clean money. The illegal funds are first introduced into the legitimate financial system to hide their real source.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. This often means transferring funds to countries outside the United States that have strict bank-secrecy laws. Once deposited in a foreign bank the funds can be moved through accounts of shell corporations which exist solely for laundering purposes. Money laundering is the illegal process of converting money earned from illegal activities into clean money that is money that can be freely used in legitimate business operations and does not have to be concealed from the authorities. This makes the process easy for launderers.

Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct.

Once deposited in a foreign bank the funds can be moved through accounts of shell corporations which exist solely for laundering purposes. This makes the process easy for launderers. Money Laundering meaning in law. Such countries include the Cayman Islands the Bahamas and Panama. Anti Money Laundering guidelines represent the rules regulations and AML obligations set to detect and prevent money laundering and other financial crimes. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics.

Source: lki.lk

Source: lki.lk

The complete liberalisation of the financial sector. Features of Money Laundering. Money Laundering meaning in law. Thanks to intelligent data analysis the Source of Funds Check provides you with tamper-proof evidence from a credible and independent source. Or participating in or assisting the movement of funds to make the proceeds appear legitimate.

Source: calert.info

Source: calert.info

This makes the process easy for launderers. Money Laundering in Banking Money laundering is the term used to describe the act of making illegal money produced from one source look like it came from somewhere else. Open Banking offers innovative methods to support the fight against money laundering and terrorist financing. A banker must report to the central bank through proper authority if he detects any unusual transactions in his bank. Anti Money Laundering guidelines represent the rules regulations and AML obligations set to detect and prevent money laundering and other financial crimes.

Source: jagranjosh.com

Source: jagranjosh.com

So Money Laundering is. The complete liberalisation of the financial sector. Money Laundering refers to converting illegally earned money into legitimate money. Features of Money Laundering. Or participating in or assisting the movement of funds to make the proceeds appear legitimate.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

This often means transferring funds to countries outside the United States that have strict bank-secrecy laws. Innovative Legally Compliant and Digital Thanks to Open Banking. So Money Laundering is. Meaning of Money Laundering. Or participating in or assisting the movement of funds to make the proceeds appear legitimate.

Source: iuricorn.com

Source: iuricorn.com

Anti Money Laundering guidelines represent the rules regulations and AML obligations set to detect and prevent money laundering and other financial crimes. What Is Anti-Money Laundering in Banking. Thanks to intelligent data analysis the Source of Funds Check provides you with tamper-proof evidence from a credible and independent source. Or participating in or assisting the movement of funds to make the proceeds appear legitimate. The illegal funds are first introduced into the legitimate financial system to hide their real source.

Source: bi.go.id

Source: bi.go.id

Or participating in or assisting the movement of funds to make the proceeds appear legitimate. It is assumed that due to preventive measures taken by all government against money laundering remittance to Bangladesh through banking channels has increased manifold. Money laundering is the illegal process of converting money earned from illegal activities into clean money that is money that can be freely used in legitimate business operations and does not have to be concealed from the authorities. Is when a financial institution such as banks is owned or controlled by unscrupulous individuals suspected of conniving with drug dealers and other organised crime groups. The dirty money is often moved around to create confusion through wire transfers to numerous accounts.

Along with some other aspects of underground economic activity rough estimates have been put forward to give some sense of the scale of the problem. This article will examine the Financial Action Task Force FATF global Anti-Money Laundering regulators in general the anti-money laundering regulations published by the European Union and the Anti Money Laundering Policy of the banking sector. Innovative Legally Compliant and Digital Thanks to Open Banking. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. Money Laundering meaning in law.

Source: efinancemanagement.com

Source: efinancemanagement.com

Anti Money Laundering Monitoring And Its Significance In The Banking Sector AML monitoring is also called non-manual crime as sometimes highly ranked authorities and politically exposed people are indulged in it. This often means transferring funds to countries outside the United States that have strict bank-secrecy laws. Anti Money Laundering Monitoring And Its Significance In The Banking Sector AML monitoring is also called non-manual crime as sometimes highly ranked authorities and politically exposed people are indulged in it. Meaning of Money Laundering. Open Banking offers innovative methods to support the fight against money laundering and terrorist financing.

Open Banking offers innovative methods to support the fight against money laundering and terrorist financing. How Does Money Laundering Happen in Banking. Money laundering means billions of pounds and dollars a year are laundered through our financial systems. The dirty money is often moved around to create confusion through wire transfers to numerous accounts. Present participle of launder 2.

Source: jagranjosh.com

Source: jagranjosh.com

The illegal funds are first introduced into the legitimate financial system to hide their real source. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics. Open Banking offers innovative methods to support the fight against money laundering and terrorist financing. Money laundering is the conversion or transfer of property. This makes the process easy for launderers.

Source: ppt-online.org

Source: ppt-online.org

The main reason for money laundering is to clean illegal money in a convenient manner which gradually mixing it with clean money. This makes the process easy for launderers. What Is Anti-Money Laundering in Banking. Open Banking offers innovative methods to support the fight against money laundering and terrorist financing. Layering Crimes that generate significant financial proceeds such as theft extortion drug trafficking and human trafficking almost always require a money laundering component so that criminals can avoid detection by authorities and use the illegal money that.

Source: moneylaundry.vercel.app

Source: moneylaundry.vercel.app

The dirty money is often moved around to create confusion through wire transfers to numerous accounts. The dirty money is often moved around to create confusion through wire transfers to numerous accounts. Thanks to intelligent data analysis the Source of Funds Check provides you with tamper-proof evidence from a credible and independent source. The acquisition possession or use of property knowing that these are derived from criminal activity. The illegal funds are first introduced into the legitimate financial system to hide their real source.

Open Banking offers innovative methods to support the fight against money laundering and terrorist financing. Anti Money Laundering Monitoring And Its Significance In The Banking Sector AML monitoring is also called non-manual crime as sometimes highly ranked authorities and politically exposed people are indulged in it. A banker must report to the central bank through proper authority if he detects any unusual transactions in his bank. Money Laundering refers to converting illegally earned money into legitimate money. The main reason for money laundering is to clean illegal money in a convenient manner which gradually mixing it with clean money.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title laundering meaning banking by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas